Key Findings

- Particular person earnings taxes are a serious supply of state authorities income, constituting 38 p.c of state taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions.

collections in fiscal 12 months 2022, the most recent 12 months for which information can be found. - Forty-three states and the District of Columbia levy particular person earnings taxes. Forty-one tax wage and wage earnings. New Hampshire solely taxes dividend and curiosity earnings whereas Washington solely taxes capital positive factors earnings. Seven states levy no particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges enhance with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the biggest supply of tax income within the U.S.

in any respect. - Amongst these states taxing wages, 12 have a single-rate tax construction, with one price making use of to all taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and companies, taxable earnings differs from—and is lower than—gross earnings.

. Conversely, 29 states and the District of Columbia levy graduated-rate earnings taxes, with the variety of brackets various extensively by state. Hawaii has 12 brackets, probably the most within the nation. - States’ approaches to earnings taxes fluctuate in different particulars as properly. Some states double their single-filer bracket widths for married filers to keep away from a “marriage penaltyA wedding penalty is when a family’s total tax invoice will increase due to a few marrying and submitting taxes collectively. A wedding penalty sometimes happens when two people with related incomes marry; that is true for each high- and low-income {couples}.

.” Some states index tax brackets, exemptions, and deductions for inflationInflation is when the overall value of products and companies will increase throughout the economic system, lowering the buying energy of a forex and the worth of sure belongings. The identical paycheck covers much less items, companies, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off on account of increased prices and “bracket creep,” whereas rising the federal government’s spending energy.

; many others don’t. Some states tie their normal deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was almost doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

and private exemption to the federal tax code, whereas others set their very own or supply none in any respect.

Particular person earnings taxes are a serious supply of state authorities income, accounting for 38 p.c of state tax collections. Their significance in public coverage is additional enhanced by people being actively liable for submitting their earnings taxes, in distinction to the oblique fee of gross sales and excise taxes.

Forty-three states levy particular person earnings taxes. Forty-one tax wage and wage earnings. New Hampshire solely taxes dividend and curiosity earnings whereas Washington solely taxes capital positive factors earnings. Seven states levy no particular person earnings tax in any respect.

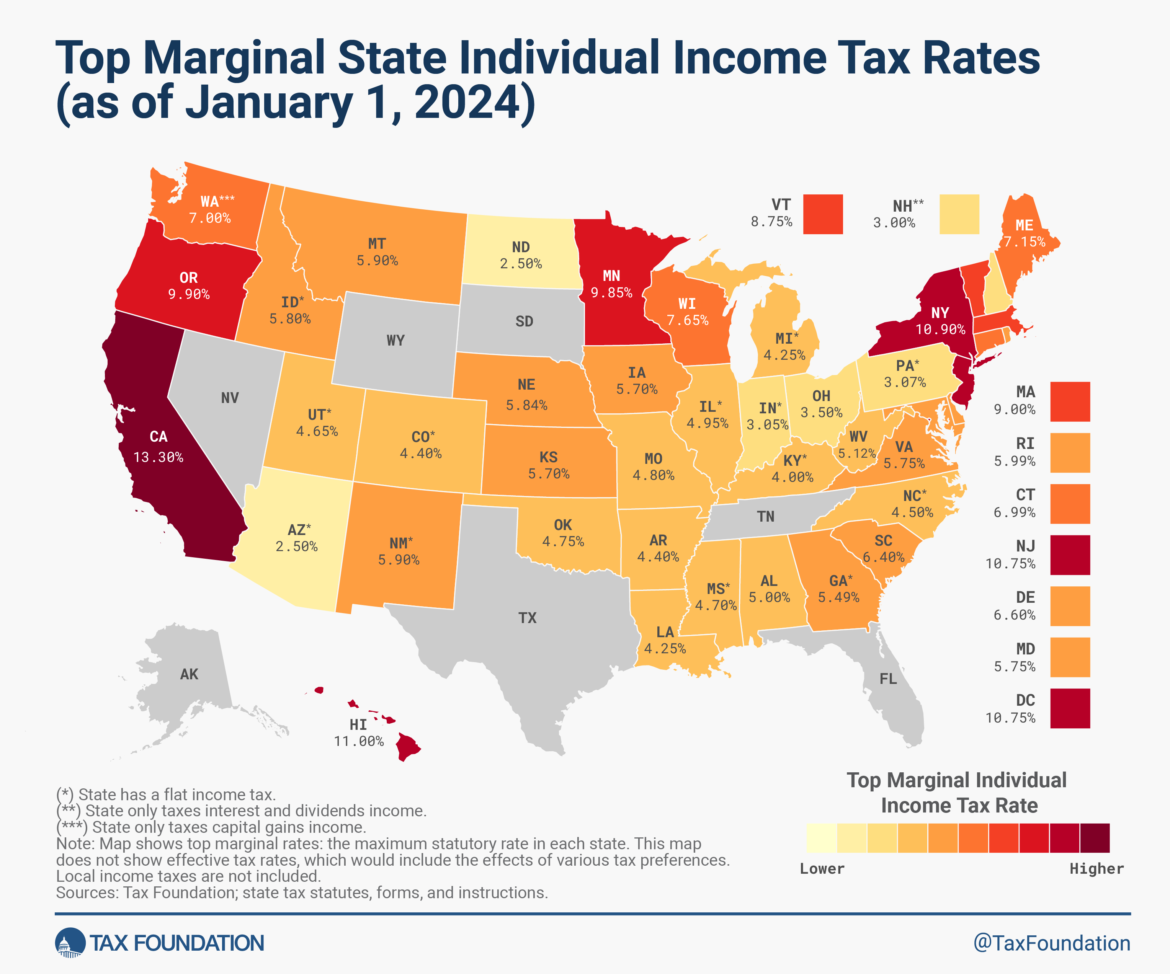

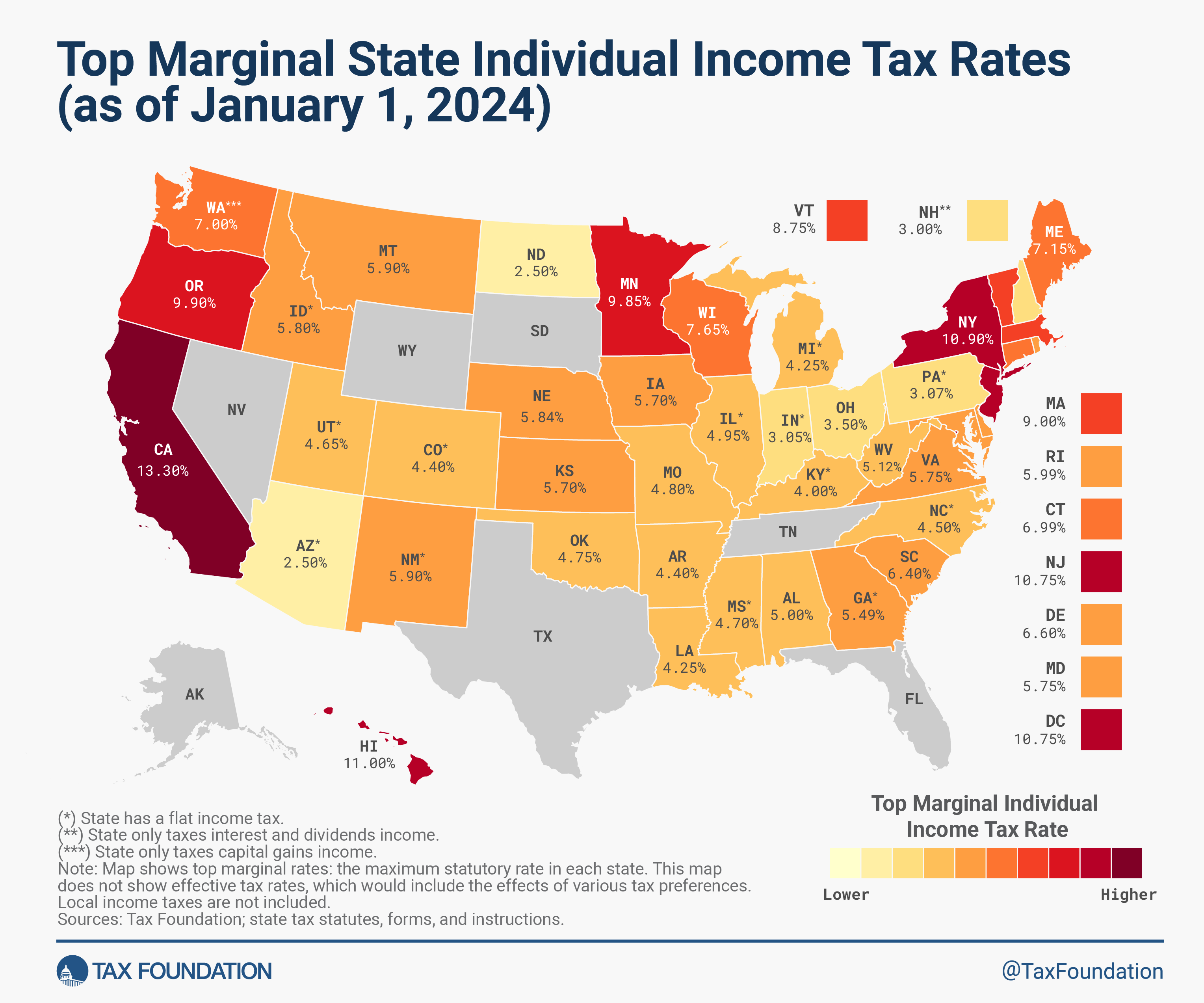

Of these states taxing wages, 12 have single-rate tax buildings, with one price making use of to all taxable earnings. Conversely, 29 states and the District of Columbia levy graduated-rate earnings taxes, with the variety of brackets various extensively by state. Montana, for instance, is one in all a number of states with a two-bracket earnings tax system. On the different finish of the spectrum, Hawaii has 12 brackets. Prime marginal charges span from Arizona’s and North Dakota’s 2.5 p.c to California’s 13.3 p.c. (California additionally imposes a 1.1 p.c payroll taxA payroll tax is a tax paid on the wages and salaries of workers to finance social insurance coverage packages like Social Safety, Medicare, and unemployment insurance coverage. Payroll taxes are social insurance coverage taxes that comprise 24.8 p.c of mixed federal, state, and native authorities income, the second largest supply of that mixed tax income.

on wage earnings, bringing the all-in high price to 14.4 p.c as of this 12 months.)

In some states, a lot of brackets are clustered inside a slender earnings band. For instance, Virginia’s taxpayers attain the state’s fourth and highest bracket at $17,000 in taxable earnings. In different states, the highest price kicks in at a a lot increased stage of marginal earnings. For instance, the highest price kicks in at or above $1 million in California (when the “millionaire’s tax” surcharge is included), Massachusetts, New Jersey, New York, and the District of Columbia.

The desk under reveals how every state’s particular person earnings tax is structured. Examine states with no earnings tax, flat earnings taxes, or graduated-rate earnings tax.

Revenue Tax Buildings by State

States’ approaches to earnings taxes fluctuate in different particulars as properly. Some states double their single-filer bracket widths for married filers to keep away from imposing a “marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation, whereas many others don’t. Some states tie their normal deductions and private exemptions to the federal tax code, whereas others set their very own or supply none in any respect.

The Tax Cuts and Jobs Act (TCJA) elevated the usual deduction (set at $14,600 for single filers and $29,200 for joint filers in 2024) whereas suspending the private exemption by lowering it to $0 via 2025. As many states use the federal tax code as the place to begin for their very own normal deduction and private exemption calculations, some states that beforehand linked to those provisions within the federal tax code have up to date their conformity statutes in recent times. They both adopted federal modifications, retained their earlier deduction and exemption quantities, or maintained their very own separate system whereas rising the state-provided deduction or exemption quantities.

Within the following tables, we now have compiled probably the most up-to-date information obtainable on state particular person earnings tax charges, brackets, normal deductions, and private exemptions for each single and joint filers. Following the tables, we doc notable particular person earnings tax modifications applied in 2024.

2024 State Revenue Tax Charges and Brackets

Notable 2024 State Particular person Revenue Tax Adjustments

Final 12 months continued the historic tempo of earnings tax price reductions. In complete, 26 states enacted particular person earnings tax price reductions from 2021 to 2023. Solely Massachusetts and the District of Columbia elevated their high marginal tax charges in these years. A number of modifications applied later in 2023 had been retroactive to January 1, 2023. Nevertheless, numerous notable modifications come into impact on January 1, 2024, or are set to happen on particular future dates, with charges phasing down incrementally over time. A few of the scheduled future price reductions depend on tax triggers, the place particular modifications to tax charges will happen as soon as sure income benchmarks are met. Notable modifications to main particular person earnings tax provisions already licensed for 2024 embrace the next:

Arkansas

Underneath S.B. 8, enacted in September 2023, the highest particular person earnings tax price in Arkansas was decreased from 4.7 p.c to 4.4 p.c for tax years starting on or after January 1, 2024. This high price applies to incomes between $24,300 and $87,000 for taxpayers incomes $87,000 or much less and to incomes over $8,801 for taxpayers incomes greater than $87,000.

Connecticut

As a part of the state price range invoice, H.B. 6941, Connecticut legislators decreased particular person earnings tax charges for the 2 lowest brackets, from 3 p.c to 2 p.c and from 5 p.c to 4.5 p.c, respectively. The change comes into impact on January 1, 2024. The discount is not going to have an effect on taxpayers with an annual earnings of $150,000 or above ($300,000 or above for married {couples} submitting a joint return).

Georgia

On January 1, 2024, Georgia transitions from a graduated particular person earnings tax with a high price of 5.75 p.c to a flat taxAn earnings tax is known as a “flat tax” when all taxable earnings is topic to the identical tax price, no matter earnings stage or belongings.

with a price of 5.49 p.c. Moreover, the state considerably elevated its private exemption (to $12,000 for single taxpayers and $18,500 for married {couples} submitting a joint return). These modifications had been enacted by H.B. 1437 in April 2022.

Indiana

Underneath H.B. 1001, enacted in Could 2023, Indiana accelerated its beforehand enacted tax price reductions, decreasing the person earnings tax price from 3.15 in 2023 to three.05 p.c in 2024. The legislation additionally repealed beforehand enacted tax triggers, as an alternative prescribing a price discount to three.0 p.c in 2025, 2.95 p.c in 2026, and a pair of.9 p.c in 2027 and past.

Iowa

As a part of its complete tax reform, efficient January 1, 2024, Iowa consolidated its 4 particular person earnings tax brackets into three (H.F. 2317). Because of this, its high price decreased from 6 p.c to five.7 p.c. The state is at present transitioning to a flat earnings tax system with a price of three.9 p.c by 2026.

Kentucky

H.B. 1, signed into legislation in February 2023, decreased Kentucky’s flat particular person earnings tax price from 4.5 p.c in 2023 to 4.0 p.c beginning in 2024, codifying a discount that was triggered beneath the situations established by H.B. 8, enacted in 2022.

Mississippi

Underneath H.B. 531, enacted in April 2022, Mississippi will proceed lowering its flat particular person earnings tax price from 2024 to 2026. Efficient January 1, 2024, the tax price decreased from 5 p.c to 4.7 p.c (utilized on taxable earnings exceeding $10,000).

Missouri

Efficient January 1, 2024, Missouri’s Division of Income decreased its high particular person earnings tax price from 4.95 p.c to 4.8 p.c because the respective income triggers had been met within the earlier fiscal 12 months, per S.B. 3 enacted in October 2022.

Montana

S.B. 121, enacted in March 2023, simplified the person earnings tax system in Montana and, efficient January 1, 2024, decreased the variety of tax brackets from seven to 2 with the highest tax price of 5.9 p.c. Moreover, beginning in 2024, taxpayers will use their federal taxable earnings as a base for calculating Montana taxable earnings, implying that the federal normal deduction or the sum of itemized deductions can be routinely accounted for.

Nebraska

L.B. 754, enacted in Could 2023, decreased the highest particular person earnings tax price from 6.64 p.c in 2023 to five.84 p.c in 2024 and outlined the gradual discount of the state’s high price to three.99 p.c by 2027.

New Hampshire

New Hampshire continues to part out its curiosity and dividends tax. In 2024, per H.B. 2, the tax price will go down from 4 p.c to three p.c. Beginning in 2025, the tax can be repealed, two years sooner than initially deliberate.

North Carolina

Underneath H.B. 259, enacted in September 2023, North Carolina accelerated the discount of its flat particular person earnings tax price. Efficient January 1, 2024, the tax price decreased from 4.75 p.c to 4.5 p.c. The speed is scheduled to say no to three.99 p.c by 2026.

Ohio

H.B. 33, enacted in July 2023, decreased the variety of particular person earnings tax brackets in Ohio from three to 2 and lowered the highest price from 3.75 p.c to three.5 p.c, persevering with the person earnings tax price discount and simplification pattern that state legislators began in 2021.

South Carolina

Efficient January 1, 2024, South Carolina decreased its high particular person earnings tax price from 6.5 p.c to six.4 p.c, per S.B. 1087. Additional reductions to six p.c are scheduled however are topic to normal fund income triggers. Governor McMaster’s executive budget assumes that the income set off for the earlier fiscal 12 months was met, and the highest price should go down additional to six.3 p.c, as per the statutory schedule. The change has not but been confirmed by the state’s Division of Income.

Historic State Particular person Revenue Tax Charges

Obtain Information (2015-2024)

Share