Newest Updates

- Up to date to replicate the most recent particulars in President Biden’s FY 2025 price range.

- Initially printed following President Biden’s 2024 State of the Union Deal with.

Final week, President Biden’s 2024 State of the Union Deal with offered a imaginative and prescient of upper taxes for American companies and excessive earners mixed with carveouts, credit, and extra complicated guidelines for taxpayers in any respect earnings ranges. On Monday, the president launched his proposed budget for fiscal 12 months 2025 outlining how the White Home would implement the president’s taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions.

imaginative and prescient, amounting to a gross tax hike exceeding $5.1 trillion over 10 years.

Fairly than aiming for a less complicated tax code that broadly encourages funding, saving, and work in the US, the president has promised greater taxes that will lower financial output and incomes, scale back U.S. competitiveness, and additional complicate the tax code.

Whereas the Biden price range claims to scale back deficits as a share of the financial system over the subsequent decade, that declare is predicated on a number of unrealistic assumptions, together with:

- No extension of the person and property taxAn property tax is imposed on the web worth of a person’s taxable property, after any exclusions or credit, on the time of loss of life. The tax is paid by the property itself earlier than property are distributed to heirs.

cuts from the 2017 Tax Cuts and Jobs Act (TCJA) which can be set to run out on the finish of 2025, regardless of signaling curiosity in extending the tax cuts for individuals incomes below $400,000, which might value a minimum of $1.4 trillion over the 10-year price range window - No extension of the administration’s proposed growth of the kid tax credit score past 2025, which might value greater than $1 trillion over the price range window

- Financial development properly in extra of what’s forecast by the Congressional Finances Workplace (CBO)

The FY 2025 Biden price range consists of the next main modifications, starting in 2024 until in any other case famous:

Main Enterprise Tax Provisions in Biden Finances

- Enhance the company tax fee from 21 p.c to twenty-eight p.c

- Enhance the company various minimal tax (CAMT) on guide earningsE-book earnings is the quantity of earnings firms publicly report on their monetary statements to shareholders. This measure is helpful for assessing the monetary well being of a enterprise however usually doesn’t replicate financial actuality and may end up in a agency showing worthwhile whereas paying little or no earnings tax.

tax fee from 15 p.c to 21 p.c - Disallow deductions for worker compensation above $1 million

- Quadruple the inventory buyback tax from 1 p.c to 4 p.c

- Make everlasting the surplus enterprise loss limitation for pass-through companies

- Remove the foreign-derived intangible deduction (FDII) and substitute it with unspecified analysis & improvement (R&D) incentives

- Repeal the bottom erosion and anti-abuse tax (BEAT) and substitute it with an undertaxed earnings rule (UTPR) according to the OECD/G20 world minimal tax mannequin guidelines

- Elevate taxes on fossil gasoline corporations and oil extraction

Main Particular person, Capital Positive aspects, and Property Tax Provisions in Biden Finances

- Increase the bottom of the web funding earnings tax (NIIT) to incorporate nonpassive enterprise earnings and improve the charges for the NIIT and the extra Medicare tax to achieve 5 p.c on earnings above $400,000

- Enhance high particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years previous, particular person earnings taxes are the most important supply of tax income within the U.S.

fee to 39.6 p.c on earnings above $400,000 for single filers and $450,000 for joint filers - Tax long-term capital positive factors and certified dividends at odd earnings tax charges for taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and firms, taxable earnings differs from—and is lower than—gross earnings.

above $1 million and tax unrealized capital positive factors at loss of life above a $5 million exemption ($10 million for joint filers) - Create a 25 p.c “billionaire minimal tax” to tax unrealized capital positive factors of high-net-worth taxpayers

- Restrict retirement account contributions for high-income taxpayers with massive particular person retirement account (IRA) balances

- Tax carried curiosity as odd earnings for these incomes over $400,000

- Restrict 1031 like-kind exchanges to $500,000 in positive factors

- Tighten property and generation-skipping tax (GST) guidelines

- Tighten tax guidelines for digital property, together with cryptocurrency, and impose a brand new 30 p.c excise taxAn excise tax is a tax imposed on a particular good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and sometimes make up a comparatively small and risky portion of state and native and, to a lesser extent, federal tax collections.

on electrical energy prices related to digital asset mining

Main Tax Credit scoreA tax credit score is a provision that reduces a taxpayer’s ultimate tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which scale back taxable earnings, relatively than the taxpayer’s tax invoice immediately.

Provisions in Biden Finances

- Lengthen the American Rescue Plan Act (ARPA) little one tax credit score (CTC) via 2025 and make the CTC totally refundable on a everlasting foundation (efficient 2023)

- Completely prolong the ARPA earned earnings tax credit score (EITC) growth for employees with out qualifying youngsters (efficient 2023)

- Completely prolong the ARPA premium tax credit growth

- Make everlasting the brand new markets housing tax credit score and supply new tax credit for dwelling shopping for and promoting

Further Main Provisions in Biden Finances

- Increase federal guidelines on drug pricing provisions

- Make everlasting the exclusion of scholar mortgage forgiveness from earnings tax

Word: In a forthcoming replace, we’ll estimate the financial, income, and distributional results of the key tax proposals within the FY 2025 price range.

The tax modifications Biden proposes fall below three primary classes: extra taxes on excessive earners, greater taxes on U.S. companies—together with growing taxes that Biden enacted with the InflationInflation is when the overall worth of products and companies will increase throughout the financial system, lowering the buying energy of a forex and the worth of sure property. The identical paycheck covers much less items, companies, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off attributable to greater prices and “bracket creep,” whereas growing the federal government’s spending energy.

Discount Act (IRA)—and extra tax credit for a wide range of taxpayers and actions. The mixture of insurance policies would transfer the tax code additional away from simplicity, transparency, and neutrality.

President Biden reintroduced his proposal to boost the efficient tax charges paid by households with internet price over $100 million. The proposal requires these households to pay a 25 p.c minimal tax fee on an expanded definition of earnings that features unrealized capital positive factors. This implies these households would pay tax on capital positive factors even when the underlying asset has not but been offered, working as a prepayment for future capital positive factors taxA capital positive factors tax is levied on the revenue made out of promoting an asset and is commonly along with company earnings taxes, incessantly leading to double taxation. These taxes create a bias towards saving, resulting in a decrease degree of nationwide earnings by encouraging current consumption over funding.

legal responsibility.

The billionaire minimal tax, as it’s generally recognized, would improve the complexity of the tax code by utilizing a non-traditional and difficult-to-measure definition of earnings. It might require formulaic guidelines for valuing various kinds of property, fee durations that adjust by asset sort, and a separate tax system to cope with illiquid property. This tax design goes properly past worldwide norms, the place capital positive factors are taxed when realized and at decrease charges than the U.S. in lots of instances.

Aiming to deal with Medicare’s rising budgetary shortfalls, the president would elevate the hospital insurance coverage (HI) payroll taxA payroll tax is a tax paid on the wages and salaries of workers to finance social insurance coverage applications like Social Safety, Medicare, and unemployment insurance coverage. Payroll taxes are social insurance coverage taxes that comprise 24.8 p.c of mixed federal, state, and native authorities income, the second largest supply of that mixed tax income.

for these incomes over $400,000 from 0.9 p.c to 2.1 p.c. The online funding earnings tax (NIIT), a 3.8 p.c tax on passive funding earnings for these incomes over $200,000 (single) or $250,000 (joint), can be expanded to incorporate lively enterprise earnings. This modification would elevate high tax charges on labor and enterprise earnings whereas not doing sufficient to place entitlements on a path towards solvency.

President Biden additionally dedicated to preserving the extra funding appropriated to the Inner Income Service (IRS) as a part of the Inflation Discount Act. Biden argues this could assist elevate income from greater earners who evade taxes and would additionally enhance taxpayer companies. A lot of this new income might take time to seem because the IRS trains new workers and spends time figuring out evasion and imposing the tax legislation. Nonetheless, the opposite parts of Biden’s tax plan will push the code in a extra complicated course, making the job of the IRS to implement the legislation tougher.

President Biden proposed to boost the company earnings taxA company earnings tax (CIT) is levied by federal and state governments on enterprise earnings. Many corporations should not topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable below the person earnings tax.

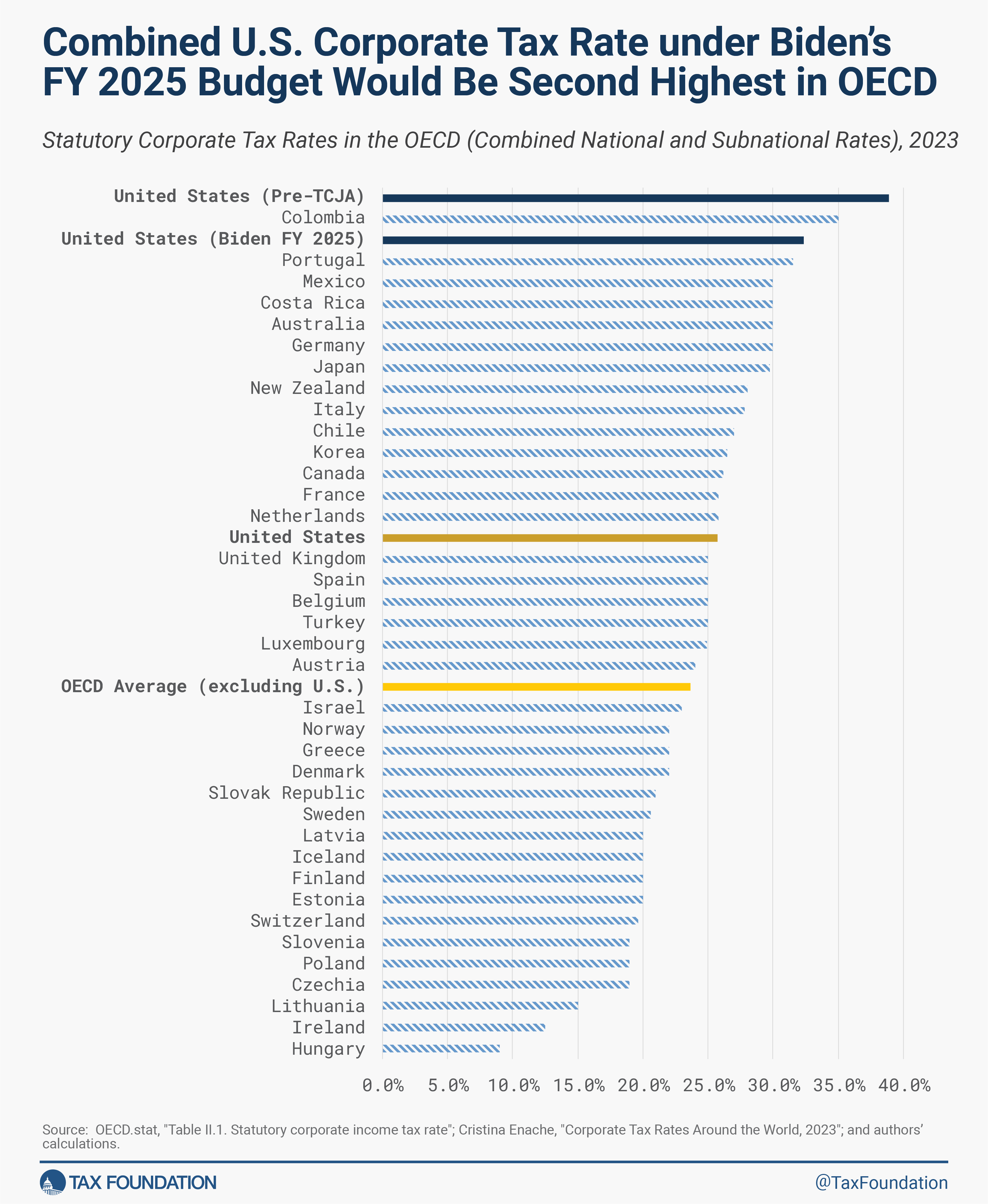

fee from 21 p.c to twenty-eight p.c, a coverage he has pushed for because the 2020 marketing campaign. The company earnings tax is probably the most dangerous tax for financial development and its many issues have led international locations world wide to scale back company tax charges significantly during the last 40 years to a median of about 23 p.c as of 2023. The U.S. had the very best company tax fee within the OECD previous to the TCJA, which lowered the U.S. company tax fee to be roughly common amongst OECD international locations. Latest research have decided that decreasing the company tax fee considerably boosted funding in the US, a long-term course of that continues to yield financial advantages, together with positive factors in employees’ wages.

Elevating the company tax fee from the present 21 p.c to twenty-eight p.c, mixed with the common state-level company tax fee, would give the U.S. the second-highest mixed company tax fee within the OECD, considerably worsening the aggressive place of U.S. companies and lowering prospects for enterprise funding and employees.

On high of a better statutory company tax fee, Biden has proposed growing the speed of the brand new company various minimal tax on guide earnings from 15 p.c to 21 p.c. The tax was enacted in August 2022 as a part of the IRA and scheduled to enter impact beginning in 2023, however the IRS postponed its implementation due to the complexity of imposing it. Taxpayers are nonetheless awaiting steerage on a number of vital questions associated to the CAMT, and it stays questionable whether or not the tax is even possible. It has definitely failed to date as an efficient minimal tax.

Biden additionally proposed quadrupling the IRA’s 1 p.c excise tax on inventory buybacks. Inventory buybacks are one of many methods companies return worth to their shareholders. Firms can return earnings to shareholders by issuing dividends (particularly money funds) or with inventory buybacks (buying shares of their very own firm). As much as 95 percent of the cash returned to shareholders from inventory buybacks subsequently will get reinvested in different public corporations. Quadrupling the tax fee would doubtless discourage corporations from pursuing inventory buybacks, probably tilting towards extra dividend issuances as an alternative, and will discourage funding.

As a brand new proposal, Biden would broaden the cap on deductions for worker compensation above $1 million (Part 162m). The cap at the moment applies to the CEO, CFO, and the subsequent three highest-paid workers of a company, and attributable to ARPA is already scheduled to broaden to the subsequent 5 extra highest-paid workers starting after 2026.

Biden’s proposal would broaden the cap to cowl all workers, elevating the price of compensating workers and making it costlier for firms to draw and retain high expertise. It might imply each the company and particular person high tax charges would apply to wages, leading to high tax charges of 70 p.c or extra together with state taxes. If the $1 million threshold just isn’t listed to inflation, over time the tax would hit extra than simply the C-suite.

Different proposed tax will increase new this 12 months embody a tax on power utilized in cryptocurrency mining operations and ending drawbacks for sure petroleum excise taxes when petroleum merchandise are imported and later exported.

Biden has known as for a number of proposals to subsidize dwelling purchases and enhance the low-income housing tax credit score, together with a tax credit score worth $5,000 per 12 months for 2 years for middle-class, first-time homebuyers. The president would additionally provide a one-year tax credit score price as much as $10,000 for middle-class households who promote a starter dwelling to assist enhance starter dwelling availability. Lastly, the president proposes to supply as much as $25,000 in down fee help for first-generation homebuyers.

Boosting demand via subsidies is prone to trigger housing costs to extend additional. What is required is a better provide of housing, which might be greatest achieved on the state and native degree by reforming zoning guidelines and on the federal degree by reforming tax depreciationDepreciation is a measurement of the “helpful life” of a enterprise asset, resembling equipment or a manufacturing facility, to find out the multiyear interval over which the price of that asset could be deducted from taxable earnings. As a substitute of permitting companies to deduct the price of investments instantly (i.e., full expensing), depreciation requires deductions to be taken over time, lowering their worth and discouraging funding.

guidelines for residential buildings.

For builders, the president would broaden the low-income housing tax credit score (LIHTC) and create a brand new neighborhood properties tax credit score to construct or renovate inexpensive homes. This method can be an inefficient solution to construct new properties as the prevailing LIHTC is expensive for the properties produced, with a lot of the credit score worth going to builders and financing companies.

President Biden would renew the expanded little one tax credit score from the 2021 American Rescue Plan Act, which might elevate the CTC worth from $2,000 to a most worth of $3,600 whereas eradicating work and earnings necessities. This CTC growth would have main fiscal prices totaling over $1 trillion over 10 years above the current-policy CTC. If we embody the underlying CTC growth from the Tax Cuts and Jobs Act that expires on the finish of 2025, the associated fee approaches $2 trillion over 10 years.

Along with the CTC growth, the president would broaden the EITC and make everlasting the expanded Reasonably priced Care Act (ACA) premium tax credit which can be scheduled to run out on the finish of 2025.

Lastly, the president recommitted to not elevating taxes on these incomes below $400,000, arguing that he would totally pay for expiring TCJA particular person tax modifications with “additional reforms” that will additional elevate taxes on excessive earners and companies. These unspecified reforms would want to complete at least $1.4 trillion to cowl TCJA extension for individuals incomes below $400,000.

The president’s tax coverage proposals as outlined within the State of the Union handle would make the tax code extra sophisticated, unstable, and anti-growth, whereas additionally increasing the quantity of spending within the tax code for a wide range of coverage objectives not associated to income assortment.

The White Home estimates the FY 2025 Biden price range would scale back the price range deficit by $3.2 trillion over 10 years. Nonetheless, this estimate doesn’t embody the price of their meant extension of the TCJA tax cuts for these incomes lower than $400,000 or for the proposed expanded CTC post-2025. These tax modifications alone would wipe out a lot of the touted deficit discount.

The Biden price range additionally assumes an unrealistically excessive fee of development within the financial system, particularly contemplating the massive tax will increase proposed on companies and excessive earners that may sluggish development. The price range assumes actual GDP will develop at 2.2 p.c yearly within the final 5 years of the price range window, whereas the CBO assumes actual GDP will develop about 1.9 p.c yearly over this era.

In sum, President Biden is proposing terribly massive tax hikes on companies and the highest 1 p.c of earners that will put the U.S. in a distinctly uncompetitive worldwide place and threaten the well being of the U.S. financial system. The Biden price range ignores or makes unrealistic assumptions concerning the fiscal value of main proposals in addition to financial development below this plan, concealing what’s prone to be a considerable value borne by American employees and taxpayers.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Subscribe

Share