Lately, a number of international locations have taken measures to cut back carbon emissions, together with instituting environmental laws, emissions buying and selling programs (ETSs), and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon taxA carbon tax is levied on the carbon content material of fossil fuels. The time period may also consult with taxing different forms of greenhouse gasoline emissions, reminiscent of methane. A carbon tax places a worth on these emissions to encourage shoppers, companies, and governments to supply much less of them.

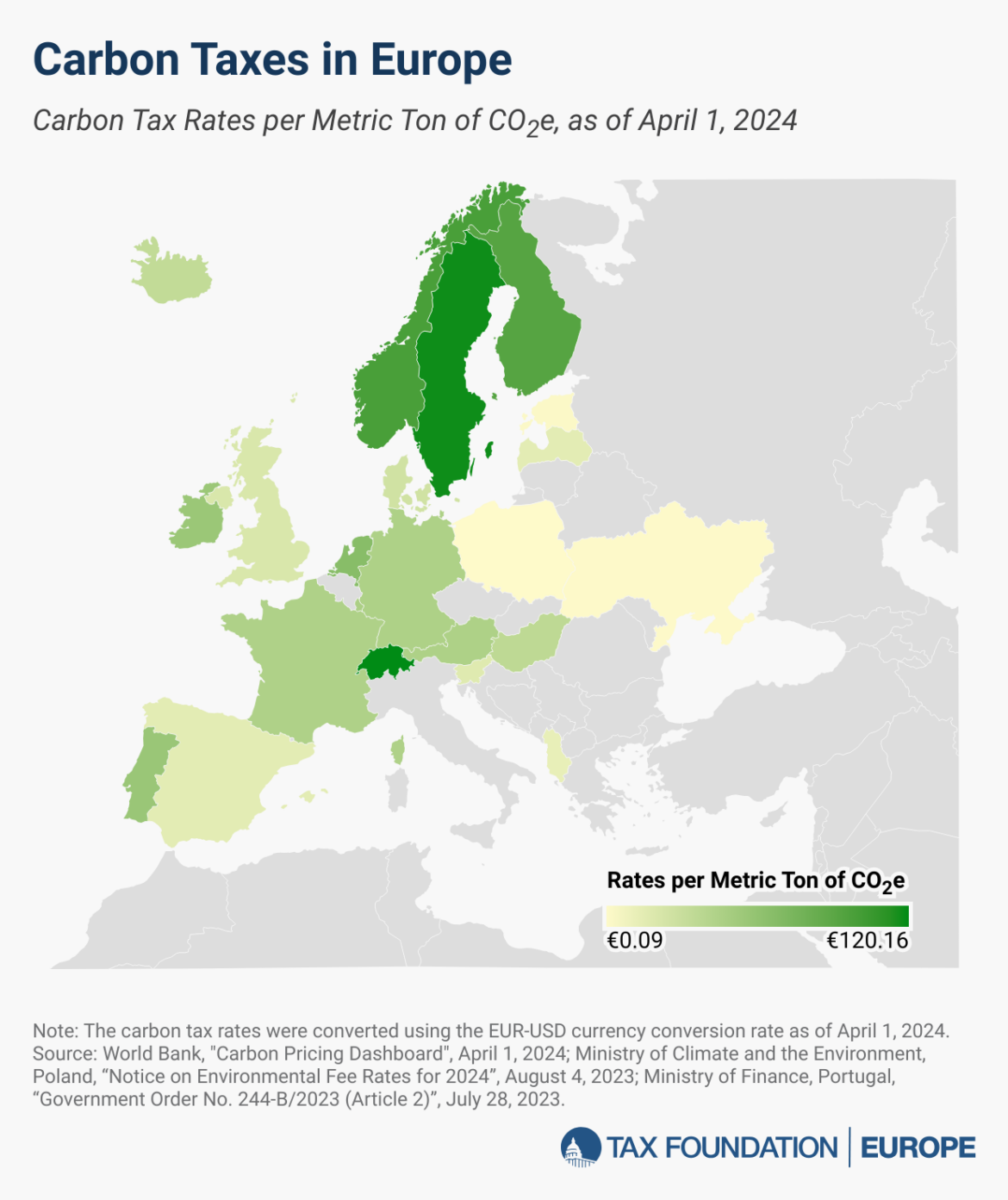

. Since then, 23 European international locations have applied carbon taxes, starting from lower than €1 per metric ton of carbon emissions in Ukraine to greater than €100 in Sweden, Liechtenstein, and Switzerland.

Switzerland and Liechtenstein at present levy the best carbon taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities providers, items, and actions.

price at €120.16 ($130.81) per ton of carbon emissions, adopted by Sweden (€115.34, $125.56) and Norway (€83.47, $90.86). The bottom carbon tax charges could be present in Poland (€0.09, $0.10) and Ukraine (€0.72, $0.77). The typical carbon tax price among the many 23 European international locations was €49.23 as of April 1, 2024.

Carbon taxes could be levied on various kinds of greenhouse gases, reminiscent of carbon dioxide, methane, nitrous oxide, and fluorinated gases. The scope of every nation’s carbon tax differs, leading to various shares of greenhouse gasoline emissions lined by the tax. For instance, Spain’s carbon tax solely applies to fluorinated gases, taxing solely 2 p.c of the nation’s complete greenhouse gasoline emissions. Albania, Liechtenstein, and Luxembourg, against this, cowl greater than 72 p.c of their greenhouse gasoline emissions.

All Member States of the European Union (plus Iceland, Liechtenstein, and Norway) are a part of the EU Emissions Buying and selling System (EU ETS), a market created to commerce a capped variety of greenhouse gasoline emission allowances. Except for Switzerland, Ukraine, and the UK, all European international locations that levy a carbon tax are additionally a part of the EU ETS. Switzerland has its personal ETS, which has been tied to the EU ETS since January 2020. Following Brexit, the UK applied its personal UK ETS in January 2021.

In a number of international locations—for instance, Estonia, Finland, Latvia, and Norway—the nationwide carbon tax baseThe tax base is the overall quantity of earnings, property, belongings, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slim tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.

overlaps with the emission base additionally lined by the EU ETS, resulting in dangerous double taxationDouble taxation is when taxes are paid twice on the identical greenback of earnings, no matter whether or not that’s company or particular person earnings.

of the overlap. When nationwide carbon taxes apply to emissions lined by an ETS, they have a tendency to shift the emissions to sources outside of their tax base, leaving complete emissions capped by ETS allowances unchanged.

Some international locations apply a number of excise taxes or ETSs to sources of carbon emissions at completely different implicit or specific tax charges. In these instances, the desk under shows the best relevant price. Ideally, a carbon tax ought to apply to the carbon emissions of all sectors on the identical price.

A number of European international locations have launched a carbon tax or an ETS lately. Germany and Austria have applied carbon taxes in 2021 and 2022, respectively, that will probably be phased into ETSs by 2026. Albania and Hungary have applied carbon taxes in 2022 and 2023, respectively. The autonomous area of Catalonia is contemplating a carbon tax on the subnational stage.

Carbon taxes have lengthy been magnets for political controversy. However from an financial standpoint, they need to be taken severely. And as with something in tax coverage, the small print and design matter significantly.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Subscribe

Share