Main Modifications from 2024 Estimates

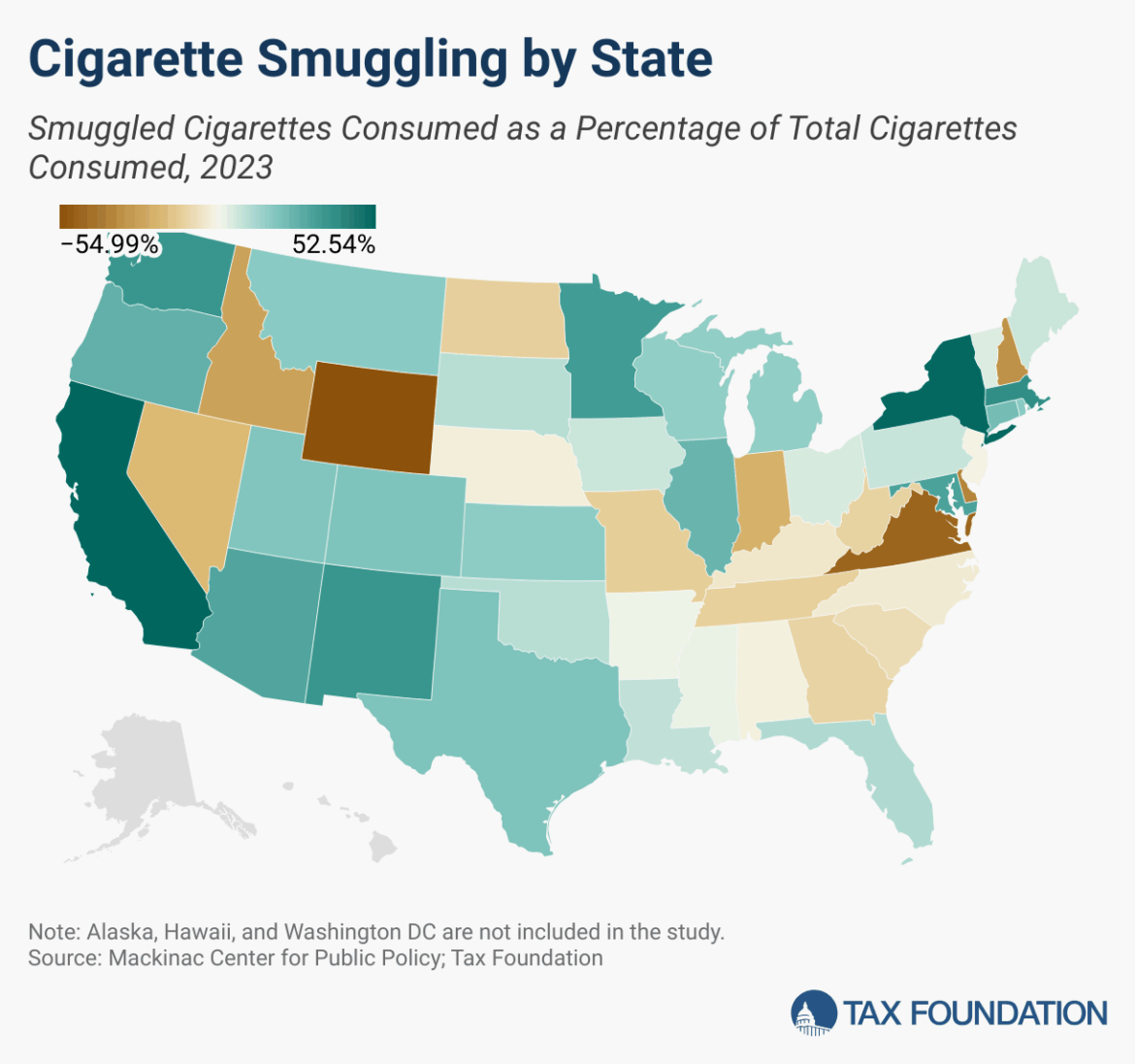

- California grew to become the biggest smuggling state with a price of 52.5 %.

- Montana was the biggest mover, enhancing 4 spots as its smuggling price modified from 20.9 % to 16.7 %.

- Maine and Pennsylvania swapped spots at ranks 24 and 26, respectively.

The rise in smuggling in California is probably going on account of our information lastly capturing the state’s prohibition on flavored cigarettes. We beforehand detailed the influence Massachusetts’ taste ban had on the state’s tobacco income and smuggling. We additionally predicted California’s taste ban would price the state tons of of thousands and thousands of {dollars} yearly—an estimate that has proved true—all whereas smoking habits remained principally unchanged. Illicit merchandise have crammed the void in authorized gross sales.

Cigarette smuggling is expensive for states. We estimate that the forgone income from smuggled cigarettes totaled greater than $4 billion in 2023. California misplaced practically $1.5 billion in cigarette excise taxAn excise tax is a tax imposed on a particular good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and sometimes make up a comparatively small and unstable portion of state and native and, to a lesser extent, federal tax collections. collections, and New York missed out on greater than $800 million.

Virginia was the biggest benefactor of smuggling-related cigarette tax income, netting the state greater than $62 million. Indiana was second highest, with internet smuggling producing greater than $61 million for the Hoosier State.

Proof from taste bans in Massachusetts and now California signifies that, simply as with alcohol prohibition within the Twenties, shoppers can and can purchase prohibited merchandise. Whereas consumption stays largely unchanged, shoppers get pushed to illicit markets that usually have extra harmful merchandise and prop up refined organized felony enterprises supplying their demand. Taste bans and nicotine bans (or efficient bans from FDA inaction) burden shoppers, home authorized companies, and states that lose tax income and face greater enforcement prices. Actually, felony organizations appear to be the one beneficiaries.

Whereas some states might profit from cross-border commerce, no state advantages from the illicit market of smuggled and counterfeit cigarettes. Many of those illicit cigarettes are smuggled from China, the place an estimated 400 billion counterfeit cigarettes are produced yearly. Counterfeit cigarettes are sometimes extra harmful, containing poisonous heavy metals and different contaminants, and among the billions of {dollars} moved by means of cigarette smuggling internationally fund terrorism.

State enforcement businesses bear extra burdens attempting, and virtually fully failing, to fight these large-scale smuggling operations. Anti-smuggling activity forces in numerous states seize tons of of hundreds of {dollars}’ price of contraband cigarettes. Nevertheless, these seizures are sometimes a minuscule quantity of the general market. 5 arrests and a significant seizure of 18,000 packs of cigarettes by a multi-agency investigation in New York, for example, represented 0.007 % of estimated annual smuggling exercise within the state.

Illicit markets for tax avoidance and smuggling are additionally turning into an more and more distinguished subject within the vaping market as nicely. Lawmakers may study the teachings of cigarette taxation and prohibition and apply them to vaping regulation, however states are sometimes falling into the identical pitfalls that harm revenues, authorized companies, and shoppers.

Authorized markets undergo when untaxed and unregulated merchandise obtain vital aggressive benefits from excessive taxes and prohibitions. Illicit markets create extra risks for shoppers, and subsequently extra burdens on public well being, and undermine each legit home companies and state income era.

Policymakers ought to take into account the unintended, however foreseeable, penalties as they decide tax charges and regulatory regimes for tobacco and nicotine merchandise.