If you happen to dabbled in shopping for or promoting cryptocurrency, NFTs (non-fungible tokens), or different digital property throughout 2025, you may discover a brand new crypto tax type exhibiting up in your inbox for the upcoming tax yr: Kind 1099-DA. This new type from the IRS was designed to make digital asset reporting clearer for each taxpayers and digital asset brokers. Don’t let the prospect of yet one more new tax type scare you, although. TaxAct® may help you report your 1099-DA earnings accurately this tax season.

Let’s break down what this tax type means, who will get it, and the way to deal with it when submitting your tax return this yr.

What’s Kind 1099-DA?

Kind 1099-DA is the IRS’s new tax type used to report digital asset transactions (like gross sales of digital property, exchanges, or redemptions dealt with by digital asset brokers). Like different 1099 kinds, it’s a sort of data return used to report a particular kind of earnings — on this case, digital asset transactions.

Earlier than 2025, most crypto and different digital transactions didn’t have an ordinary reporting methodology. You might have seen digital asset transactions reported on varied different 1099 kinds, resembling:

- Kind 1099-B, which was designed for conventional investments resembling shares and bonds.

- Kind 1099-Okay, should you purchased or offered cryptocurrency utilizing a third-party fee platform like Coinbase®.

- Kind 1099-MISC, which some crypto platforms use to report earnings earned from staking, rewards, and so forth.

IRS Kind 1099-DA is supposed to modernize tax reporting for the digital economic system by creating one clear, standardized tax type only for digital asset reporting. Primarily, it’s meant to offer each the IRS and tax filers like your self with a clearer image of your gross proceeds, value foundation, and total tax legal responsibility from digital asset transactions. It also needs to make it simpler for taxpayers to precisely disclose transactions and adjust to tax legal guidelines.

What’s a digital asset?

For tax functions, the IRS considers digital property to be property reasonably than foreign money. The company defines a digital asset as “any digital illustration of worth recorded on a cryptographically secured, distributed ledger (blockchain) or comparable expertise.”

Some examples:

- Convertible digital foreign money and cryptocurrency (like Bitcoin®, Ethereum®, or stablecoins)

- Non-fungible tokens (NFTs)

Mainly, if you should purchase, promote, or commerce it utilizing a crypto pockets, it in all probability counts as a digital asset for tax functions.

Who must file a 1099-DA type?

You gained’t really file this kind your self. As a substitute, your dealer or digital asset platform will problem Kind 1099-DA to you (and the IRS) should you had reportable digital asset transactions through the tax yr.

Listed below are some examples of occasions which may end in getting a 1099-DA:

- You offered cryptocurrency for U.S. {dollars} or exchanged one coin for one more.

- You offered an NFT you beforehand created or bought.

- You used staking or different crypto-related companies by way of a dealer.

- You obtained digital asset funds for items or companies.

When you get your 1099-DA, you’ll use it to finish your tax return, sometimes reporting particulars on Kind 8949 and Schedule D to calculate capital good points or losses. Don’t fear about this half — TaxAct will information you thru step-by-step, mechanically coming into all the small print in order that your digital asset transactions are reported precisely.

Kind 1099-DA instance

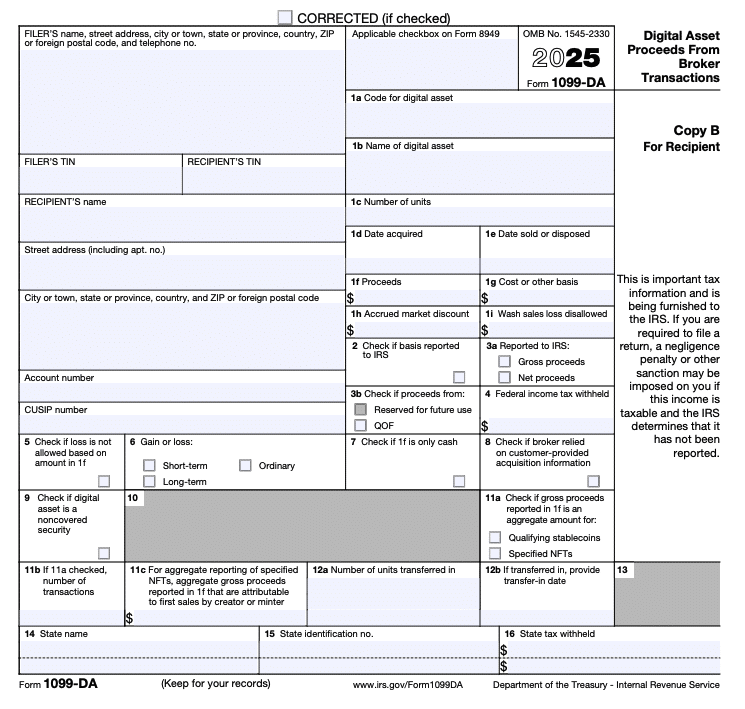

Under is an instance of what the Kind 1099-DA appears to be like like:

Every field contains necessary data reporting particulars resembling:

- Your taxpayer identification quantity (TIN)

- The dealer’s title and get in touch with data

- Gross proceeds out of your digital transactions

- Price foundation (if out there)

- Any backup withholding that was utilized

- Transaction particulars like pockets addresses or blockchain IDs

Kind 1099-DA directions: What does Kind 1099-DA report?

Every field on Kind 1099-DA supplies necessary particulars about your digital asset transactions (like how Kind 1099-B experiences inventory trades). Not all bins will all the time be used relying on the kind of transaction, however right here’s a breakdown of what every field may embody and what it means in your tax return:

- Field 1a: Code for digital asset: A code figuring out the precise kind of digital asset concerned within the transaction.

- Field 1b: Title of digital asset: The total title of the asset you offered, exchanged, or transferred.

- Field 1c: Variety of items: Exhibits the whole amount of the digital asset offered, exchanged, or disposed of.

- Field 1d: Date acquired: The date you initially bought, mined, or in any other case obtained the digital asset.

- Field 1e: Date offered or disposed: The date you offered, traded, or in any other case removed the asset.

- Field 1f: Proceeds: The full gross proceeds from the sale or trade. That is the whole worth you obtained after promoting. If you happen to had a loss, it could seem in parentheses as a unfavourable quantity.

- Field 1g: Price or different foundation: What you paid for the digital asset (adjusted for charges or different prices). That is used to find out your capital good points or losses.

- Field 1h: Accrued market low cost: Any market low cost that has constructed up because you acquired the asset. A market low cost happens while you purchase an asset for lower than its face worth. This will get taxed as bizarre earnings reasonably than a capital acquire.

- Field 1i: Wash sale loss disallowed: Exhibits any wash sale losses that may’t be claimed since you repurchased a “considerably equivalent digital asset” inside 30 days. Learn more about IRS wash sale rules for digital assets.

- Field 2: Your dealer will examine this field in case your value foundation was reported to the IRS (not required for tax yr 2025).

- Field 3a: Tells you whether or not the IRS was given your gross proceeds (complete sale quantity) or internet proceeds (after charges).

- Field 3b: In case your digital asset transaction includes a Qualified Opportunity Fund (QOF), this field will probably be checked.

- Field 4: Federal earnings tax withheld: Exhibits any backup withholding your dealer withheld for you. This may occur should you don’t present your TIN to the dealer.

- Field 5: Field will probably be checked in case your reported loss doesn’t qualify resulting from particular IRS guidelines.

- Field 6: Acquire or loss: Signifies how your digital asset transaction is handled for tax functions: short-term, long-term, or bizarre earnings.

- Field 7: If checked, confirms that Field 1f comprises solely money proceeds, not different asset sorts.

- Field 8: If checked, your dealer used your knowledge (not theirs) to report data like acquisition dates or value foundation.

- Field 9: This checkbox identifies whether or not the digital asset is a noncovered safety (that means the dealer isn’t required to report foundation data to the IRS).

- Field 11a: In case your dealer is reporting gross sales of a digital asset eligible for optionally available reporting, this field signifies the kind of digital asset (qualifying stablecoins or specified NFTs).

- Field 11b: The full variety of digital asset transactions from Field 11a.

- Field 11c: Exhibits the whole gross proceeds from an NFT creator’s first gross sales.

- Field 12a: Variety of items transferred in: Exhibits what number of digital property had been transferred into the dealer’s platform.

- Field 12b: Lists the date the dealer obtained the digital property.

Every of those bins helps the IRS match your digital asset proceeds with what you report in your Kind 8949 and Schedule D.

Kind 1099-DA FAQs

The way to file Kind 1099-DA with TaxAct

Once you use TaxAct’s tax preparation software, you’ll merely reply a number of questions on your digital asset transactions. Then, we’ll mechanically fill out the suitable tax kinds (together with Kind 8949 and Schedule D) to make sure your crypto tax data is reported precisely to the IRS.

The underside line

Kind 1099-DA will roll out in phases — brokers will begin reporting gross proceeds for 2025 transactions, with full value foundation reporting to comply with in 2026 and later tax years. So, should you commerce crypto, NFTs, or different digital property, count on to begin seeing this kind in early 2026 (in your 2025 transactions).

However don’t let this new tax type stress you out. TaxAct may help you report every thing to the IRS with out trouble. Our easy-to-use tax software program walks you thru your crypto tax questions and makes positive every thing will get reported accurately in your tax return, so that you don’t have to fret.

This text is for informational functions solely and never authorized or monetary recommendation.

Kind 1099-DA is barely out there with sure TaxAct On-line merchandise.

All TaxAct presents, services and products are topic to applicable terms and conditions.

All emblems not owned by TaxAct, Inc. that seem on this web site are the property of their respective homeowners, who are usually not affiliated with, related to, or sponsored by or of TaxAct, Inc.