Gross sales taxes are an essential income supply for states that preserve them. All states besides Alaska, Delaware, Montana, New Hampshire, and Oregon have statewide gross sales taxes. Whereas the state has no such taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities providers, items, and actions.

, Alaska localities are permitted to implement and gather gross sales taxes.

Previous to the Supreme Court docket’s 2018 determination in South Dakota v. WayfairSouth Dakota v. Wayfair was a 2018 U.S. Supreme Court docket determination eliminating the requirement {that a} vendor have bodily presence within the taxing state to have the ability to gather and remit gross sales taxes to that state. It expanded states’ skills to gather gross sales taxes from e-commerce and different distant transactions.

, solely sellers with a bodily presence in a state might be required to gather and remit state gross sales taxes. (States typically bought artistic by means of concepts like “click-through nexus” or “cookie nexus” in an effort to avoid the restriction.) The Wayfair courtroom, nonetheless, acknowledged the altering nature of the economic system and the rise of e-commerce and overturned a long time of precedent, permitting states to start taxing non-resident companies promoting into the state.

Following the choice, states acted rapidly to start requiring out-of-state market facilitators and distant sellers to gather and remit gross sales taxes. This impacted each giant and small sellers and elevated compliance obligations that usually disproportionately fall on small- and medium-sized sellers. The elevated compliance prices are additional compounded by the shortage of uniformity among the many numerous taxing jurisdictions.

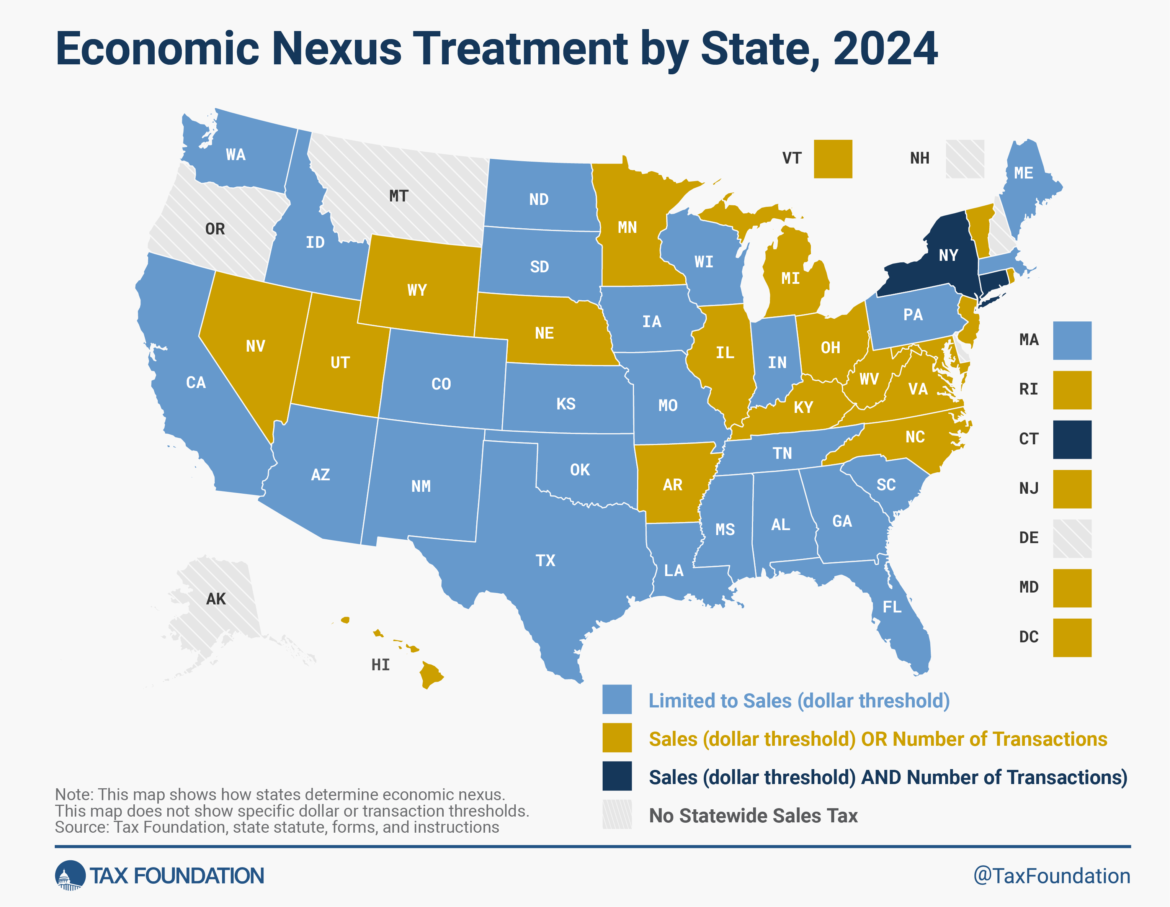

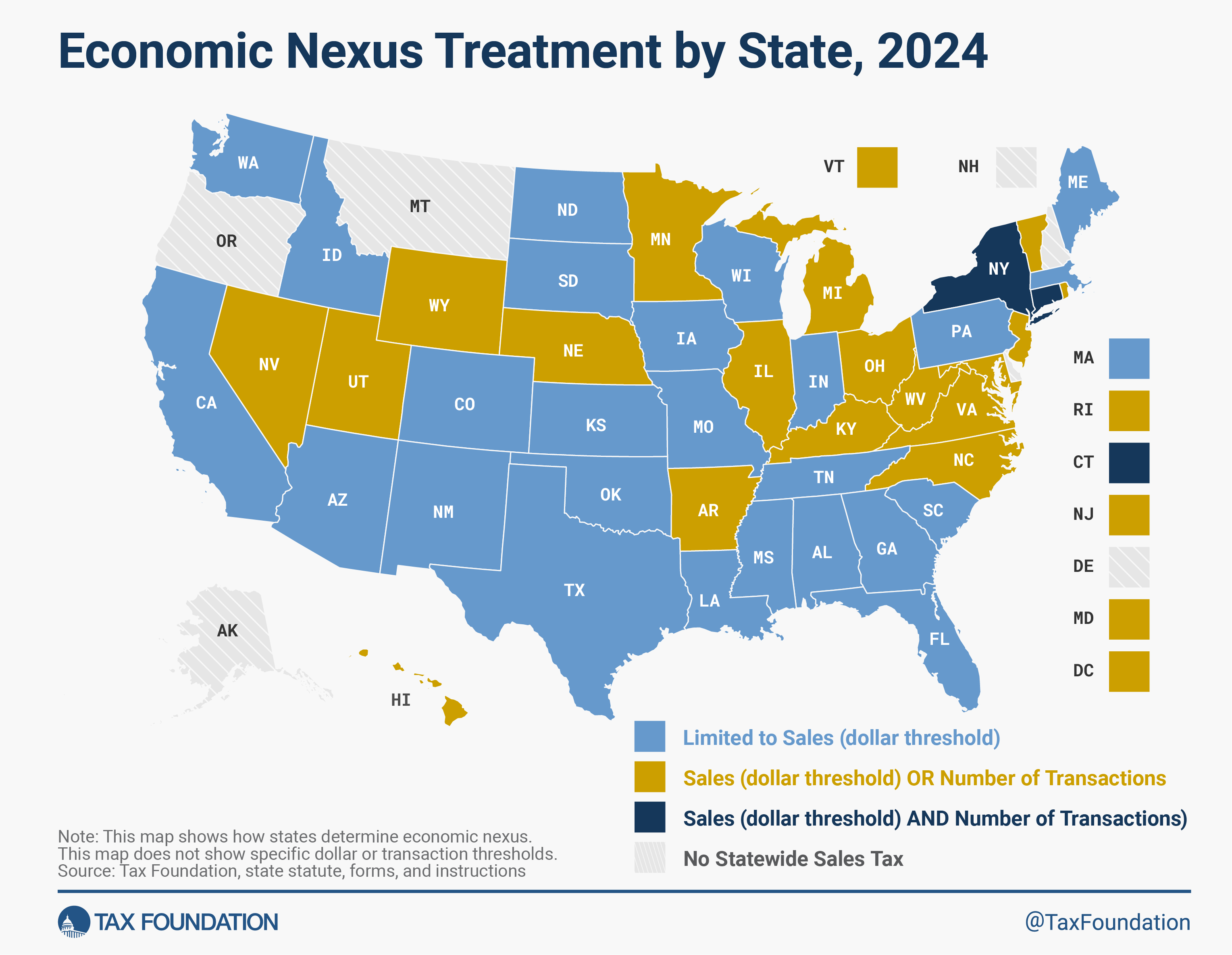

At the moment, 25 states restrict financial nexus to gross sales assembly a greenback threshold (e.g., $200,000). Others, nonetheless, require that market facilitators and distant sellers gather and remit gross sales taxes if both a greenback threshold is met or the vendor conducts a sure variety of transactions within the state.

Establishing financial nexus by means of transactions alone is sort of burdensome as compliance prices related to assortment and remittance necessities might be higher than the enterprise transacted. For instance, a market facilitator or distant vendor with gross sales in Arkansas exceeding $100,000 is required to gather and remit gross sales taxA gross sales tax is levied on retail gross sales of products and providers and, ideally, ought to apply to all closing consumption with few exemptions. Many governments exempt items like groceries; base broadening, equivalent to together with groceries, might maintain charges decrease. A gross sales tax ought to exempt business-to-business transactions which, when taxed, trigger tax pyramiding.

. The identical vendor would even be topic to assortment and remittance obligations if the vendor carried out 200 or extra transactions within the state. To place a finer level on this, promoting 200 of the identical merchandise at a worth of $5 for a complete of $1,000 can be adequate to require the vendor to adjust to the Arkansas gross sales tax assortment and remittance guidelines, though the overall income was dramatically lower than the $100,000 gross sales threshold. This hypothetical vendor would nearly definitely spend extra complying with the legislation (e.g., specialised software program to trace gross sales, accounting providers, and so on.) than they obtain in earnings on these gross sales, making doing enterprise in Arkansas unappealing.

Nineteen states restrict their financial threshold determinations to greenback quantities alone. That is imperfect however definitely higher than requiring the smallest on-line companies to gather and remit gross sales tax. Connecticut and New York don’t impose an obligation to gather and remit gross sales tax except the distant vendor or market facilitator meets or exceeds each a gross sales and transactions threshold.

The Wayfair courtroom was right in highlighting the altering nature of the economic system and the need for gross sales tax codes to adapt. Nevertheless, the choice did little to outline how states ought to require gross sales tax assortment and remittance from market facilitators and distant sellers. Consequently, there’s a irritating lack of uniformity among the many states, which creates inefficiencies disproportionately borne by small and mid-sized sellers.

States ought to reform their market facilitator and distant vendor guidelines and take away the transaction threshold altogether. Indiana just lately grew to become the newest state to make the swap, a optimistic and pro-growth tax reform that others ought to observe. Reforming financial nexus thresholds wouldn’t solely be higher for companies however for states as effectively. It’s more cost effective for states to give attention to—and simplify—compliance for an affordable variety of sellers than to impose guidelines which have low compliance and are pricey to manage.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Subscribe

Share