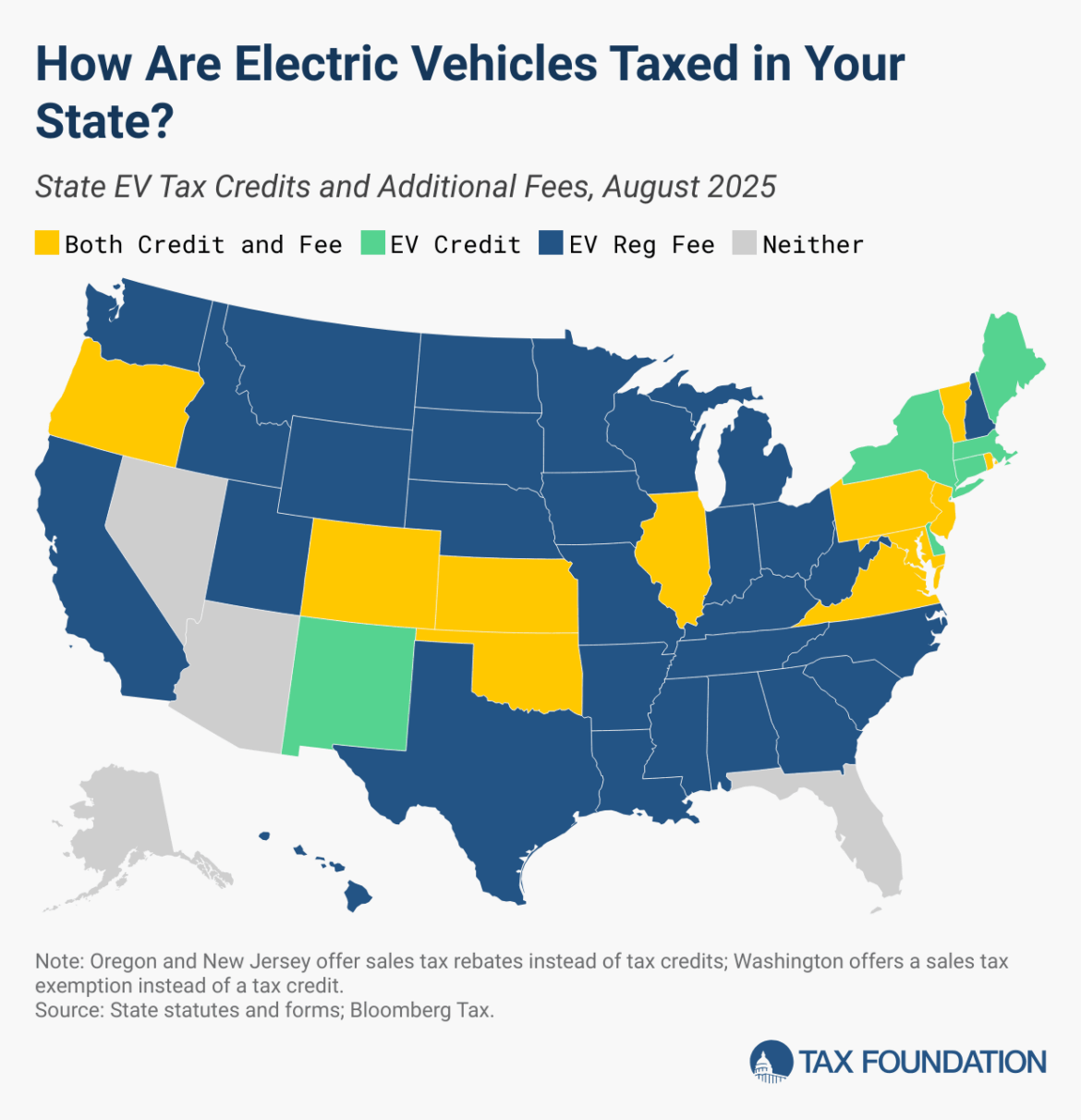

For a number of years, residents of all states have been eligible to obtain a federal tax credit of $7,500 for certified EV purchases. Nevertheless, this tax credit score ends for automobiles bought after September 30, 2025. Seventeen states provide an extra incentive past the federal credit score, starting from a $1,500 incentive in Rhode Island to a $7,500 credit score in Oregon and Maine.

Opposite to a tax incentive, 40 states impose the next annual car registration charge for EVs and a few hybrid automobiles to assist offset forgone fuel tax income. These charges vary from $50 in Hawaii and South Dakota to $260 in New Jersey. These, nevertheless, have typically been justified as modest efforts to defray the dearth of fuel tax collections from EVs, which can be extra environmentally pleasant, however nonetheless put put on and tear on roads.

Main Modifications Since July 2023

- California and Alaska ended their electrical car tax credit score packages.

- New Mexico launched a brand new electrical car tax credit score.

- Maryland, Montana, New Hampshire, New Jersey, Pennsylvania, Rhode Island, Texas, and Vermont launched new registration charges for electrical automobiles.

- Tennessee elevated the registration charge for electrical automobiles from $100 to $200.

- Kansas elevated the registration charge for electrical automobiles from $70 to $165.

- Indiana elevated the registration charge for electrical automobiles from $150 to $230.

- Nebraska elevated the registration charge for electrical automobiles from $75 to $150.

- Wisconsin elevated the registration charge for electrical automobiles from $100 to $175.

- North Carolina elevated the registration charge for electrical automobiles from $140.25 to $214.50.

Eleven states each provide an incentive for the acquisition of an EV and impose the next registration charge for EVs than for combustion engine automobiles. The desk under summarizes these insurance policies.

One other response by states to backfill reductions in fuel tax collections has been to implement a tax on EV charging stations. States like Georgia, Iowa, Kentucky, and Oklahoma impose a tax per kilowatt-hour distributed by charging stations. Whereas this added person charge could assist equalize therapy between combustion engines and EVs, as a result of many customers cost their EVs at dwelling, these taxes can fail to totally account for EV street use.

Increased registration charges and EV charging station taxes are an try to raised join car miles traveled (VMT) to transportation and street funding, but in some situations, they’re carried out in battle with insurance policies aimed toward rising EV adoption. A less complicated transportation coverage resolution could be a VMT tax.

A VMT tax is levied on the variety of miles traveled by a person car. That is normally completed by odometer studying or by means of a GPS gadget. Whereas there are privateness considerations with the usage of GPS units to trace VMT, relying purely on odometer readings can lead to drivers being charged for miles pushed outdoors of the taxing state.

Furthermore, as units and apps utilized by insurance coverage suppliers to trace protected driving develop into commonplace, related instruments could possibly be used to immediately hyperlink the miles traveled to public street and infrastructure spending within the correct jurisdiction.

At the moment, 4 states have active VMT tax packages:

- Oregon drivers with automobiles rated above 20 mpg are allowed to choose to pay $0.02 per mile pushed as an alternative of the state’s $115 electrical car registration charge. Miles traveled are tracked by both an odometer plugin or a telematic gadget. This was enacted in 2013.

- Utah electrical car drivers could choose to pay $0.0111 per mile pushed, as much as the worth of the state’s electrical car registration charge. That is tracked through an app. This system was enacted in 2020.

- Virginia permits drivers with automobiles rated above 25 mpg to choose right into a per mile cost based mostly on the car’s gasoline effectivity. For electrical car drivers, this worth is ready to $0.0114 per mile. Mileage is tracked through an OBD plugin. This was enacted in 2022.

- Hawaii started the HiRUC program on July 1, 2025, permitting electrical car drivers to pay both $0.008 per mile or a $50 flat charge. The mileage is measured by odometer studying. Due to the state’s distinctive geographic scenario, odometer-only reporting will probably keep away from the problem of taxing out-of-state journey. This was enacted in 2025.

Vermont was anticipated to start the same program in 2025, however implementation has been postponed to 2027. Moreover, California and Washington have run important VMT pilot packages.

The state EV taxation panorama displays the evolving transportation sector and the urgent want to deal with each fiscal gaps in street funding and environmental considerations. Because the EV market continues to evolve and know-how advances, it’s probably that tax insurance policies may also adapt.