For those who’ve not too long ago struck gold on the on line casino, hit the jackpot in a poker event, or skilled the fun of the lottery or every other playing exercise, you’re most likely questioning in regards to the potential tax implications.

Spoiler alert: all of your winnings, huge or small, money or noncash have to be reported to the IRS.

Whether or not you’re a seasoned or skilled gambler or somebody who merely received fortunate on the bingo corridor or in a fantasy league showdown, understanding the ins and outs of the playing winnings tax is essential.

We’ll dive into the nitty-gritty questions in your playing winnings and taxes and assist to demystify the whole course of for you.

What varieties of playing winnings are thought-about taxable revenue?

When evaluating taxable vs. non-taxable revenue, all varieties of playing winnings are thought-about taxable revenue. This is applicable even should you aren’t knowledgeable gambler. For those who win cash from lotteries, raffles, horse races, or casinos – that cash is topic to revenue tax.

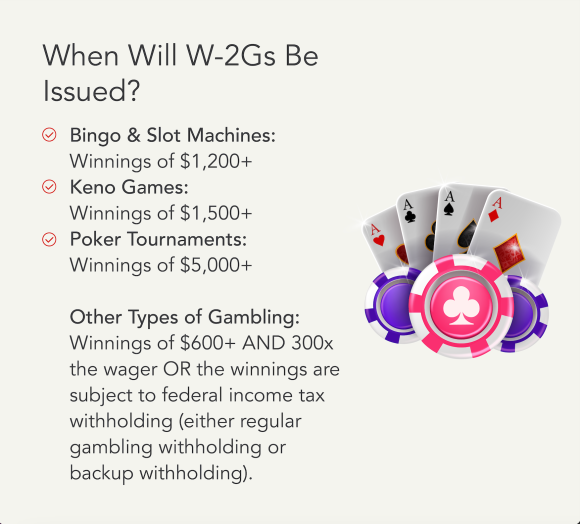

If you win, the entity paying you’ll challenge you a Kind W2-G, Sure Playing Winnings, if the win is massive sufficient. This manner is just like the 1099 type and serves as a file of your playing winnings and as a heads-up to the IRS that you simply’ve hit the jackpot.

You then should report all playing winnings in your tax return. Even should you don’t obtain the Kind W2-G, you’re nonetheless obligated to report all of your playing wins in your taxes. Whether or not it’s the slot machines or poker video games, the IRS doesn’t discriminate in relation to reporting your playing winnings.

How are playing winnings taxed?

If you win, your winnings are handled as taxable revenue. Even non money winnings like prizes are to be included in your tax return at their truthful market worth. For those who win, understanding when every kind of playing class is required to challenge to report your winnings is essential for you when gathering your tax paperwork precisely and with confidence.

Fantasy league winnings

For those who win your fantasy soccer league (or in case your league awards comfort finishers), it’s all taxable revenue within the eyes of the IRS. For those who win $600 or above, the playing facility ought to ask to your social safety quantity to allow them to report your winnings to the IRS, however keep in mind, even should you don’t obtain a type reporting your revenue, you continue to have to say your winnings in your taxes.

On line casino winnings

For those who win huge at on line casino desk video games, corresponding to blackjack, craps, or roulette, there’s no obligation for federal revenue tax withholdings or the issuance of Kind W-2G.

Nonetheless, you continue to should report your winnings in your IRS tax return even when the winnings didn’t end in a tax type, so preserve correct information of all of your buy-ins and winnings at casinos.

Poker tournaments

For those who win more than $5,000 in web playing winnings from a poker event, then this cash ought to be reported on a Kind W2-G. Hold correct information of your wager or buy-in quantities, as this can be utilized to offset your reported winnings.

The organizers will challenge Kind W-2G so that you can report along with your tax return.

Bingo, keno, and slot machines

For those who win greater than $1,200 in bingo or slot machines and greater than $1,500 in keno after the value of the wager or buy-in, then a W-2G ought to be supplied to you so that you can report in your tax return and a replica may even be supplied to the IRS by the payer.

Do sportsbooks and casinos report playing winnings to the IRS?

For those who win at a sportsbook or on line casino, they’re legally obligated to report your winnings to the IRS and to you should you win as much as a specific amount ($600 on sports, $1,200 on slots, and $5,000 on poker).

Are playing winnings taxed on each the federal and state degree?

The tax charge on playing winnings will sometimes fluctuate from state to state. Nearly all of states have revenue taxes, which implies that playing winnings are possible topic to each federal and state taxation.

For federal taxes, there are two varieties of withholdings on playing winnings: a daily playing withholding 24% (or 31.58% for sure noncash funds) and again withholding additionally at 24%. In case your successful is already topic to common playing federal revenue tax withholding you gained’t even be topic to backup withholding.

The foundations and charges of your playing wins and taxes can fluctuate considerably relying in your state. Some states take your playing winnings tax at a flat charge, whereas different states tie it to your general revenue tax charge.

Check your state’s specific guidelines on their playing winnings tax charge when it comes time to report your winnings.

The right way to report your playing winnings in your taxes

Reporting your playing winnings is a vital step in getting your taxes achieved and staying within the good graces of the IRS. For those who’ve gained a considerable quantity, the payer – whether or not it’s a on line casino, racetrack, sports activities website, or lottery fee – will challenge you Kind W-2G.

Form W-2G details your playing winnings and any taxes withheld. It’s a key doc for whenever you file your revenue tax return, as you’ll want to incorporate these winnings in your complete revenue.

Even when your playing winnings are usually not substantial and you weren’t issued Kind W-2G, you’re nonetheless required to report your winnings as a part of your complete revenue.

Whether or not you gained the lottery or a sweepstakes or just loved a little bit of pleasant competitors, maintaining monitor and reporting your playing revenue is essential to remain on the proper facet of tax laws.

For those who didn’t obtain a W2-G to your playing winnings taxes, you’ll report them in your tax return Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040).

Are the principles totally different for skilled gamblers?

For those who interact in playing actions as a method of livelihood and pursue it usually as knowledgeable gambler, then some guidelines can fluctuate. Nonetheless, deductions from losses that exceed the revenue of your winnings are nonetheless not allowed.

Whereas informal gamblers solely have to report their winnings as a part of their general revenue on their tax varieties, skilled gamblers might file a Schedule C as self-employed people. They are able to deduct their gambling-related bills, corresponding to journey or on line casino entry charges, to find out their web revenue.

With reference to losses, deductions for playing losses have to be less than or equal to playing winnings.

Are you able to deduct playing losses?

You possibly can deduct losses out of your playing, however provided that you itemize your deductions and preserve an correct file of your playing winnings and losses. The quantity of losses you deduct can’t be greater than the quantity of playing winnings you report in your tax return.

Beneath tax reform, you’ll be able to solely deduct losses instantly associated to your wagers and never non-wagering bills like travel-related bills to playing websites.

Deducting playing losses: An instance

Playing losses might be deducted as much as the quantity of playing winnings. For instance, should you had $10,000 in playing winnings in 2024 and $5,000 in playing losses, you’ll be capable to deduct the $5,000 of losses should you itemize your tax deductions.

For those who had losses larger than your positive aspects, you wouldn’t be capable to declare the surplus loss quantity. Reversing the instance above, should you had $5,000 in playing winnings and $10,000 in playing losses, you’ll solely be capable to deduct solely $5,000 of playing losses.

The remaining $5,000 in losses could be misplaced ceaselessly; you’ll be able to’t carry the losses ahead to the subsequent 12 months.

Documenting playing losses

Whereas your winnings are reported by the payer on a Kind W2-G, your losses might not be reported. You’ll have to produce different documentation to validate the deduction. This may embody:

- Wagering receipts or tickets

- Canceled checks

- Different receipts

It could even be doable to determine your losses by maintaining some kind of detailed log. This log ought to embody data such because the:

- Date and sort of playing exercise

- Individuals you gambled with

- Quantity of your winnings and losses

Playing Winnings FAQs

Do senior residents must pay taxes on playing winnings?

Sure, even senior residents must pay taxes on playing winnings because it’s thought-about taxable revenue. All playing and loitering winnings are topic to the 24% federal tax withholding, in addition to state and native taxes.

Visiting casinos and playing are common pastimes for a lot of seniors, however earlier than you partake, it might be value noting that should you win huge, you might find yourself in a better federal tax bracket, which can lead to a better tax charge on winnings.

Will the IRS know should you’ve had playing winnings however haven’t paid?

Sure, the payer (assume on line casino) studies a replica of your winnings assertion (W-2G) to the IRS. The IRS will know should you’ve acquired playing winnings in any given tax 12 months.

Bear in mind how we talked about the W-2G and payers withholding federal revenue tax out of your winnings? These actions will notify the IRS of playing winnings, which you’ll then be liable for when it comes time to file.

How do you not pay taxes on playing winnings?

Whereas there are methods to scale back your tax invoice, it’s important that you simply stay in compliance with tax regulation and pay taxes you owe.

When it comes time to arrange your tax return, you’ll be able to reduce how a lot it’s a must to pay in your playing winnings by deducting playing losses. Word you’ll be able to’t deduct greater than the winnings you report as revenue. For instance, when you’ve got $3,000 in winnings however $6,000 in losses, your deduction is proscribed to $3,000.

For those who’re knowledgeable gambler, remember the fact that this might embody meals, journey bills, and different prices related to playing actions.

What occurs should you don’t pay taxes on playing winnings?

As with different taxable revenue, should you don’t pay taxes owed in your playing winnings, you can be topic to penalties. If these penalties aren’t paid, you may additionally be charged curiosity.

For those who’re anxious about not having the ability to afford your tax invoice on the finish of the 12 months, you might wish to think about paying estimated taxes all year long. You’re capable of make estimated funds every quarter to remain on prime of what you assume you’ll owe.

Prepare for tax time

Don’t fear about realizing these tax guidelines. It doesn’t matter what strikes you made final 12 months, TurboTax will make them depend in your taxes. Whether or not you wish to do your taxes your self or have a TurboTax expert file for you, we’ll be sure to get each greenback you deserve and your greatest doable refund – assured.