Completely different enterprise constructions have their very own execs and cons. Your enterprise construction will decide the way you’re taxed, what paperwork it’s good to file, and what you’re personally answerable for.

LLCs are in style as a result of they provide legal responsibility safety and tax advantages. However earlier than you kind one, it’s necessary to know how LLC taxes work.

On this information, we’ll define the way in which taxes are utilized to LLCs and how you can file so that you’re ready.

How are LLCs taxed?

LLCs are topic to taxation like several enterprise, however the way you’re taxed and the way you file your taxes can range based mostly on what number of members there are.

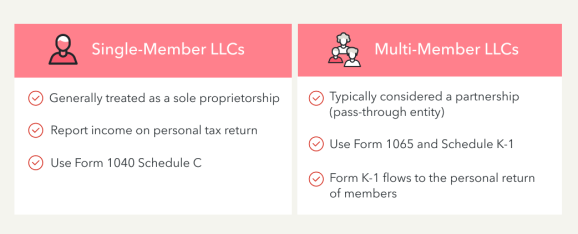

Single vs. multiple-member LLCs

If you happen to kind an LLC and also you’re the one member, you’re thought of a single-member LLC.

Single-member LLCs are basically handled as sole proprietorships, which suggests you report your revenue on Kind 1040 – Schedule C, Revenue or Loss from Enterprise.

As a single-member LLC, if you’re energetic in your online business, you’ll pay self-employment tax on your online business revenue in addition to paying revenue taxes based mostly upon your tax price in your internet revenue.

In some instances, your LLC may not be worthwhile. If you happen to report a lack of revenue out of your single-member LLC, you may deduct these losses out of your private revenue, which reduces your tax legal responsibility.

Multi-member LLCs are typically thought of partnerships. These pass-through entities don’t must pay taxes as a enterprise entity once they file Kind 1065.

As an alternative, every member is chargeable for reporting a portion of the LLC’s revenue and paying taxes on their particular person tax returns from their Kind Okay-1.

The portion every member is chargeable for paying is determined by their possession stake. For instance, if an LLC has two members with a 50/50 cut up, every member is chargeable for paying 50 % of the taxes owed on enterprise earnings.

The right way to calculate LLC taxes

Whenever you’re working a enterprise, it’s useful to at the very least have an estimate of how a lot you count on to pay in taxes. You’re thought of a self-employed particular person as a member of an LLC, which suggests your tax obligations are a bit of completely different.

If you’re an worker, your employer often deducts a portion of your revenue to pay Social Safety and Medicare taxes, however that’s not the case once you’re self-employed. As an alternative, you need to pay self-employment taxes along with the revenue taxes you owe in your LLC earnings.

The self-employment tax price is 15.3%. This price is a mixture of the 12.4% Social Safety tax and the two.9% Medicare tax. This self-employment tax is along with your revenue taxes. Nevertheless, you may deduct half of your complete self-employment tax as an revenue tax deduction.

To determine how a lot you owe, you’ll want to find out how a lot revenue you’re chargeable for reporting in your tax return. That is the quantity you employ to calculate your tax legal responsibility. Begin by multiplying your internet revenue by the self-employment tax price.

When you’ve decided the self-employment tax, you may declare half of that complete as an revenue tax deduction when calculating your revenue taxes.

Multi-member LLCs might want to decide the share of the possession stake every member has and what portion of taxes they’re chargeable for. As an LLC member, you will discover this info mirrored in your Schedule Okay-1.

Whenever you’re calculating your LLC taxes, don’t overlook about tax credit and deductions. You could possibly decrease your taxable revenue or cut back your tax legal responsibility when you qualify for sure write-offs.

The right way to file LLC taxes

As a result of single-member LLCs are handled as sole proprietorships by default, you’ll want to incorporate Schedule C once you file your Kind 1040. Most single-member LLCs will file a Schedule C, however some companies could use Schedule E or Schedule F as an alternative.

Multi-member LLCs are a bit of extra advanced. Every year, it’s good to file Kind 1065 to report revenue, features, losses, deductions, and credit. Nevertheless, this isn’t the shape used to pay your LLC taxes.

If you happen to run a multi-member LLC, you need to ship a Schedule Okay-1 to every member to allow them to know what proportion of earnings they’re chargeable for paying taxes on. These Schedule Okay-1s are sometimes due by March 15.

When every member receives their Schedule Okay-1, they are going to use it to finish their particular person tax return and pay revenue taxes on their proportion of the LLC earnings. Every member can be chargeable for paying their portion of self-employment taxes.

LLCs can elect to file as an organization by submitting Kind 8832 to be handled as a C-corporation (C-Corp) or Kind 2553 to be handled as an S-corporation (S-Corp). If you happen to elect to file as an S-Corp, you’ll use Kind 1120-S to file your online business taxes.

If you happen to file as a C-Corp, you need to use Kind 1120 to file your taxes. If neither kind is submitted, then your LLC will likely be thought of a Sole proprietorship or a partnership by default.

Be certain to notice which kinds you’ll want on your online business tax guidelines.

When are LLC taxes due?

There are a handful of LLC tax deadlines you need to be conscious of when you’re working an LLC. Assembly these deadlines helps you keep away from penalties and curiosity.

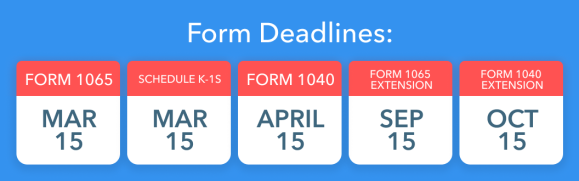

- The deadline for submitting Kind 1040 is April 15, however you may request an extension to have the deadline pushed again to October 15.

- The deadline to file Kind 1065 is March 15. You possibly can request an extension to file by September 15.

- The deadline to ship Schedule Okay-1s to every shareholder is March 15 as a result of they should use that kind to file their particular person tax return by the April 15 deadline.

If you happen to elect to file as an S-Corp, you need to file Kind 1120-S and supply a Schedule Okay-1 to every shareholder. Kind 1120-S should be filed by March 15. For C-Corps, Kind 1120 should be submitted by the April 15 deadline.

A Schedule Okay-1 is not going to be issued by C-Corps as all enterprise revenue taxes will likely be paid on the company degree.

What are the tax disadvantages of an LLC?

Whenever you’re beginning an organization, deciding on a enterprise construction might be tough. Nevertheless, it’s necessary to contemplate how your online business construction protects you, the way it impacts your taxes, and the way it compares to different enterprise constructions.

As a member of an LLC, you sometimes must pay extra taxes. Every LLC member is chargeable for paying revenue tax on enterprise earnings, however you additionally must pay the 15.3% self-employment tax.

Different varieties of companies are taxed otherwise, together with S-Corps and C-Corps. If your online business is an S-Corp or C-Corp, you don’t must pay self-employment taxes. As an S company, you pay revenue tax on enterprise revenue and any earnings as an worker. As a C-Corp, you pay company revenue taxes on enterprise revenue and revenue tax on earnings as an worker.

Forming and sustaining an LLC can be costlier resulting from submitting and renewal charges. These charges range by state, so this potential downside could also be extra notable in some states than others.

Relying in your state of affairs, it could make extra sense to kind a Sole proprietorship or elect to be handled as an S-Corp or C-Corp.

If you wish to elect to be handled as an S-Corp, you’ll must file Kind 2553. It’s essential to file Kind 2553 not more than two months and 15 days after the start of the tax 12 months in order for you the election to take impact that 12 months. You possibly can file Kind 2553 at any time in the course of the 12 months to be handled as an S-Corp the next 12 months.

You need to use Kind 8832 to elect to be handled as a C-Corp. This election can solely be utilized to a full tax 12 months, so the election will take impact the next 12 months once you file Kind 8832.

How can LLC house owners reduce their tax invoice?

There are a number of small enterprise tax suggestions you need to use to attenuate your tax invoice as an LLC.

You could be eligible to say a number of enterprise tax credit and deductions `that may assist you decrease your tax invoice, together with:

- Hire

- Insurance coverage

- Depreciation

- Workplace expense

- Skilled charges

- House workplace deduction

- Car bills

- Journey prices

- Promoting

Working with a tax skilled is likely one of the greatest methods to attenuate your tax invoice. A tax skilled can assist you file an correct tax return and discover tax credit and deductions that cut back your tax legal responsibility.