For those who’re a freelancer or a profession impartial contractor, you’re in all probability acquainted with a W-9 kind. So far as tax paperwork goes, it’s one of many higher ones as a result of it usually means you’ve received a brand new shopper! The shape makes it straightforward to submit all of your very important data to the shopper, so you can begin working and so they can begin paying you.

At a look:

- A W-9 kind gives data for issuing Kind 1099-NEC on the finish of the yr.

- Differentiate between a W-9 kind and a W-4 kind based mostly in your working relationship with the corporate; a W-9 kind is for impartial contractors, whereas W-4 is for workers.

- Replace your W-9 kind each time your data adjustments for lively purchasers.

What’s a W-9 tax kind?

Kind W-9, Request for Taxpayer Identification Quantity and Certification, is primarily used to supply the data your shopper must concern you a Kind 1099-NEC on the finish of the yr. Kind 1099-NEC paperwork non-employee compensation. It consists of comparable data to a Kind W-2, Wage and Tax Assertion.

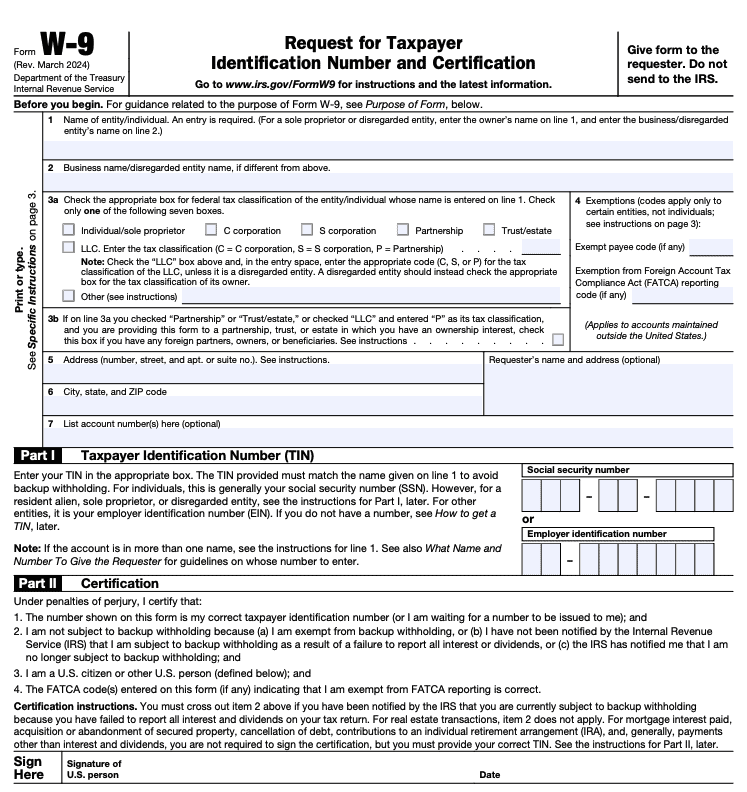

Kind W-9 instance

That is what Kind W-9 seems to be like:

The W-9 kind asks for a number of items of knowledge: your title, enterprise title (if relevant), deal with, taxpayer identification quantity (additionally referred to as a taxpayer ID or TIN), and the kind of enterprise entity you use. It’s fairly painless so far as tax paperwork goes.

Kind W-9 directions

How do I fill out a W-9?

To fill out Kind W-9, observe these steps:

- Present your private data: On the prime, fill in your title (or enterprise title, if relevant), and verify the field in your acceptable federal tax classification (e.g., particular person/sole proprietor, LLC).

- Enter your taxpayer identification quantity (TIN): That is seemingly both your Social Safety quantity (SSN) or Employer Identification Quantity (EIN). Enter the proper quantity based mostly in your tax classification.

- Certify the shape: In Half II, evaluation the certification textual content fastidiously. If all the data is correct, signal and date the shape.

- Submit the shape: Give your accomplished Kind W-9 to the individual or enterprise that requested it. You don’t ship this manner to the IRS, solely to the payer.

That’s it! Simply ensure your data is correct, because the payer will use it to report revenue paid to you.

Be careful for pink flags

Though Kind W-9 is a primary and broadly used tax doc, that doesn’t imply it is best to take any much less care with dealing with it than you’d deal with different tax and monetary paperwork. Right here are some things to look out for:

- The individual or enterprise asking you for a W-9 kind appears shady. Generally, you have to be cautious giving out delicate data like your title, deal with, and Social Safety quantity. Be sure you’re comfy with the individual or group asking for a W-9 kind earlier than you provide that data.

- Use solely safe channels to ship a W-9 tax kind. For those who select to electronic mail Kind W-9, ensure to ship it as an encrypted attachment. It’s also possible to use one other safe supply methodology, resembling hand supply or common mail.

- The aim of a W-9 kind request is unclear. For those who’re undecided why the requestor needs a Kind W-9 from you, ask them what tax paperwork they’ll use it to organize for you.

- You thought you had been getting a Kind W-4. For those who’re beginning a brand new job and the employer needs a W-9 as a substitute of a W-4, make clear whether or not you’re an worker or an impartial contractor. It’s towards the legislation for them to require you to work like an worker however pay you want a contractor.

Particular Kind W-9 data for restricted legal responsibility firms

- If the tax standing of your limited liability company (LLC) is separate from you — resembling a partnership, C-corporation, or S-corporation — record the LLC title, its federal employer identification quantity, and verify the suitable tax classification field on the W-9 tax kind. Don’t verify the “restricted legal responsibility firm” field.

- If the LLC is owned by one other LLC, verify the “restricted legal responsibility firm” field. Additionally, point out the tax classification of the mother or father LLC.

- If the LLC is owned by a single individual, record the title of the proprietor on the “title” line and the title of the LLC on the “enterprise title” line. The Inside Income Service (IRS) would reasonably have the proprietor’s Social Safety quantity as a substitute of the LLC’s federal employer identification quantity.

Kind W-9 FAQs

What’s a TIN?

A TIN is your taxpayer identification quantity, which you’ll want to supply on Kind W-9. Your TIN is usually your SSN or EIN.

When do I must fill out a W-9?

You’ll must fill out a W-9 kind when a enterprise or particular person (like a shopper or monetary establishment) requests your taxpayer identification data. A TIN request normally occurs in case you’re an impartial contractor, freelancer, or receiving sure forms of revenue, resembling curiosity, dividends, or hire. The W-9 gives your SSN or EIN to the payer, to allow them to precisely report your earnings to the IRS.

In brief, in case you’re not a conventional worker however are getting paid exterior of payroll, you’ll seemingly be requested to finish a W-9.

You might also want to supply a W-9 kind in case you use fee supplier websites like eBay® or Venmo®. Sportsbook websites might additionally want you to fill out a W-9 kind based mostly on how a lot cash you win betting on sports activities. An organization or particular person may additionally request a W-9 kind from you for actual property transactions, mortgage curiosity funds, acquisition or abandonment of secured property, cancellation of debt, or your IRA contributions. These are much less frequent, nonetheless.

Often, the celebration requesting a W-9 tax kind will present a clean one so that you can fill out. It’s also possible to simply download the form from the IRS web site. Solely the celebration that requested it wants a replica — the IRS doesn’t.

What’s the distinction between Kind W-9 vs. Kind W-4?

The enterprise you’re employed for must classify you as both an impartial contractor or an worker. For those who’re an impartial contractor, they’ll request a Kind W-9 from you. For those who’re an worker, they’ll ask you to fill out Kind W-4 to allow them to withhold payroll taxes.

While you submit a W-9, the corporate received’t withhold any taxes in your behalf. You’re accountable for paying the suitable quantity of taxes to the IRS your self, together with each the employer’s and worker’s parts of Social Safety and Medicare taxes.

It might typically be difficult to find out whether or not to finish a W-9 or W-4 based mostly on the work you do. A greater indicator is the character of the working relationship. Typically, the extra management an employer has over the way you carry out your job, the extra seemingly you’re an worker reasonably than an impartial contractor.

A fast rule of thumb: If the corporate controls key enterprise elements like the way you’re paid, whether or not bills are reimbursed, or who gives instruments and tools, you’re seemingly an worker. Advantages like pension plans, paid trip, and matching 401(okay) contributions additionally level to worker standing.

Some employers could attempt to lower prices by classifying workers as impartial contractors, avoiding their share of Social Safety and Medicare taxes. If this occurs to you, it’s essential to handle the problem promptly, as their “financial savings” will come out of your pocket.

When must you replace or ship out a brand new W-9 kind?

You have to ship a brand new W-9 kind to lively prospects or purchasers each time your data (title, enterprise title, deal with, or Social Safety quantity) adjustments.

What must you do in case you obtain a request for a W-9 tax kind from an sudden supply?

By legislation, you’re solely obligated to supply a W-9 kind to events that intend to pay you curiosity, dividends, non-employee compensation, or every other sort of reportable revenue. If somebody unexpectedly asks for a W-9, ask them why they want it. If their reply doesn’t align with any legitimate motive, you legally don’t have to supply one.

What if I don’t submit a Kind W-9?

If a enterprise appropriately requests a W-9 kind and you don’t submit one, you’ll seemingly be topic to backup withholding as much as 24% in your funds.

The underside line

Kind W-9 is a simple however essential doc for impartial contractors and freelancers. It helps guarantee your shopper has the mandatory data to precisely report your earnings to the IRS. Conserving your particulars updated and securely submitting your W-9 when requested will aid you keep away from any tax hiccups down the highway. Whereas dealing with tax varieties can really feel like a chore, getting it proper from the beginning will make tax time a breeze!