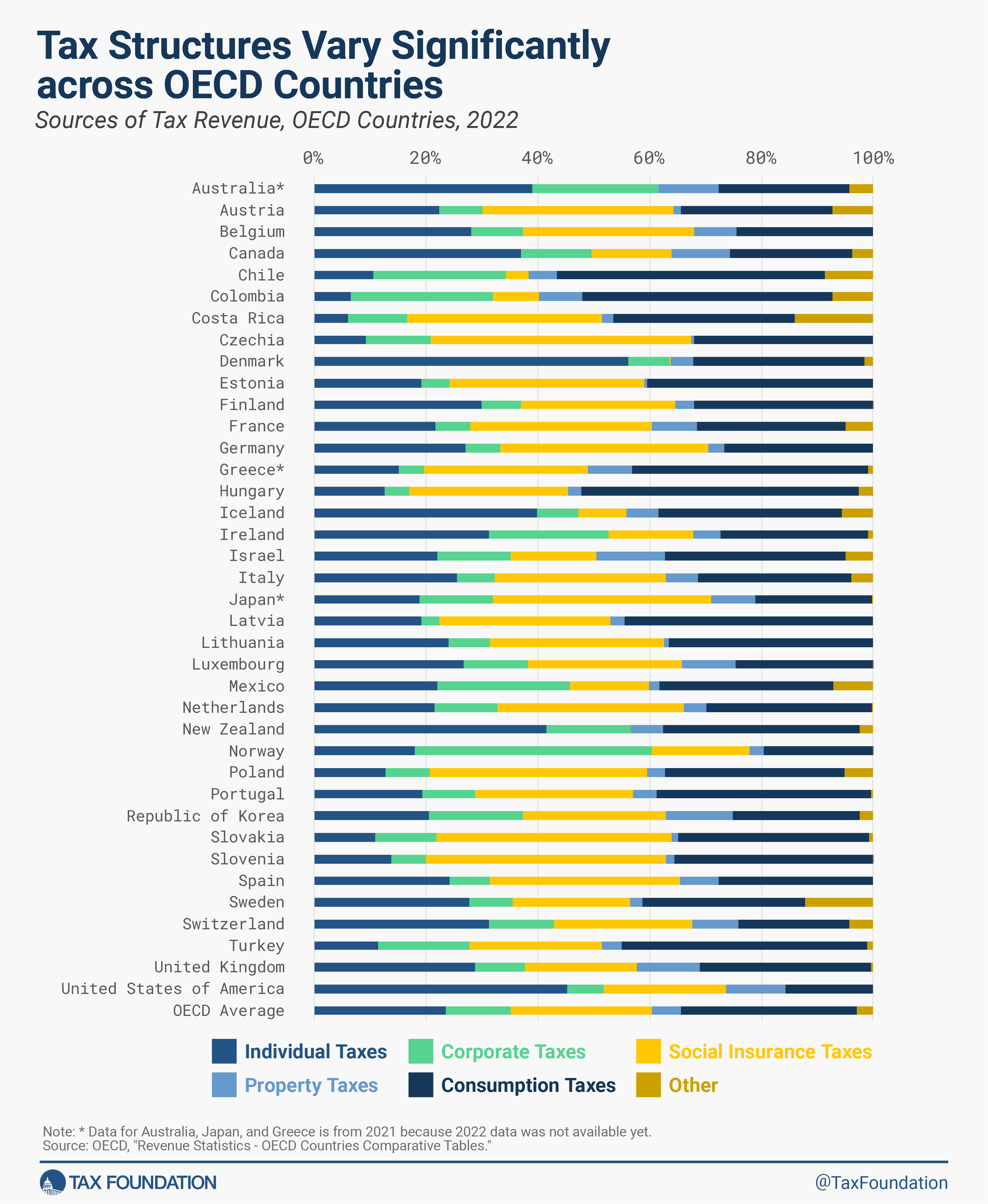

Coverage and financial variations amongst OECD nations have created variances in how they elevate taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

income, with the USA deviating considerably from the OECD common on some sources of income.

Totally different taxes have totally different financial results, so policymakers ought to all the time contemplate how tax income is raised and never simply how a lot is raised. That is particularly necessary because the financial restoration from the pandemic continues.

In the USA, particular person revenue taxes (federal, state, and native) had been the first supply of tax income in 2022, at 45.3 % of whole tax income. Social insurance coverage taxes (together with payroll taxes for Social Safety and Medicare) made up the second-largest share at 21.9 %, adopted by consumption taxes at 15.7 %, and property taxes at 10.6 %. Company revenue taxes accounted for six.5 % of whole U.S. tax income in 2022.

In comparison with the OECD common, the USA depends considerably extra on particular person revenue taxes and property taxes. Whereas OECD nations on common raised 23.6 % of whole tax income from particular person revenue taxes, the share in the USA was 45.3 %, a distinction of 21.7 share factors.

That is partially as a result of greater than half of enterprise revenue in the USA is reported on particular person tax returns. Relative to different OECD nations, the U.S. strategy to taxing enterprise revenue boosts the share of tax income from particular person revenue taxes within the U.S. and reduces the share of company tax income.

The OECD on common raised 5.4 % of whole tax income from property taxes, in comparison with 10.4 % in the USA.

America depends a lot much less on consumption taxes than different OECD nations. Taxes on items and companies accounted for less than 15.7 % of whole U.S. tax income, in comparison with 31.6 % within the OECD.

It’s because all OECD nations, besides the USA, levy value-added taxes (VAT), often at comparatively excessive charges. State and native gross sales taxA gross sales tax is levied on retail gross sales of products and companies and, ideally, ought to apply to all closing consumption with few exemptions. Many governments exempt items like groceries; base broadening, reminiscent of together with groceries, may hold charges decrease. A gross sales tax ought to exempt business-to-business transactions which, when taxed, trigger tax pyramiding.

charges in the USA are comparatively low by comparability, however they’re on a distinct tax base.

International locations even have totally different ranges of presidency at which taxes are collected. The U.S. and 9 different OECD nations have a decentralized political construction the place state or regional governments play an necessary position in tax assortment.

Practically half of U.S. tax income is raised on the state and native ranges.

Each nation’s mixture of taxes is totally different, relying on components reminiscent of its financial scenario and coverage objectives. Nonetheless, every kind of tax impacts the financial system otherwise, with some taxes being extra dangerous than others.

Usually, consumption-based taxes are a extra environment friendly income as a result of they create much less financial injury and distortionary results than taxes on revenue. Because the U.S. financial system recovers from the pandemic, policymakers ought to keep away from enacting dangerous tax will increase that place pointless burdens on U.S. employees and companies.

Associated

- Sources of Authorities Income within the OECD See extra

- Sources of State and Native Tax Income See extra

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Subscribe

Share