What does it imply to be an American firm?

Not too long ago, U.S. Commerce Consultant Ambassador Tai questioned whether or not being headquartered within the U.S. is adequate for an organization to be American or whether or not policymakers also needs to contemplate the place corporations pay taxes.

Her logic means that if an organization is headquartered in the US however primarily pays taxes to different governments due to its worldwide footprint, then U.S. commerce coverage ought to focus much less on defending its pursuits.

This pondering is defective for 3 causes. First, massive corporations headquartered within the U.S. pay the majority of their taxes to the U.S. authorities. Second, U.S. negotiators have agreed to guidelines that can scale back the quantity of taxes some multinationals can pay to the U.S. and enhance the quantity these corporations pay overseas. Third, different international locations are concentrating on U.S. corporations with discriminatory insurance policies and the U.S. strategy to digital taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

and commerce will affect the place U.S. corporations owe taxes.

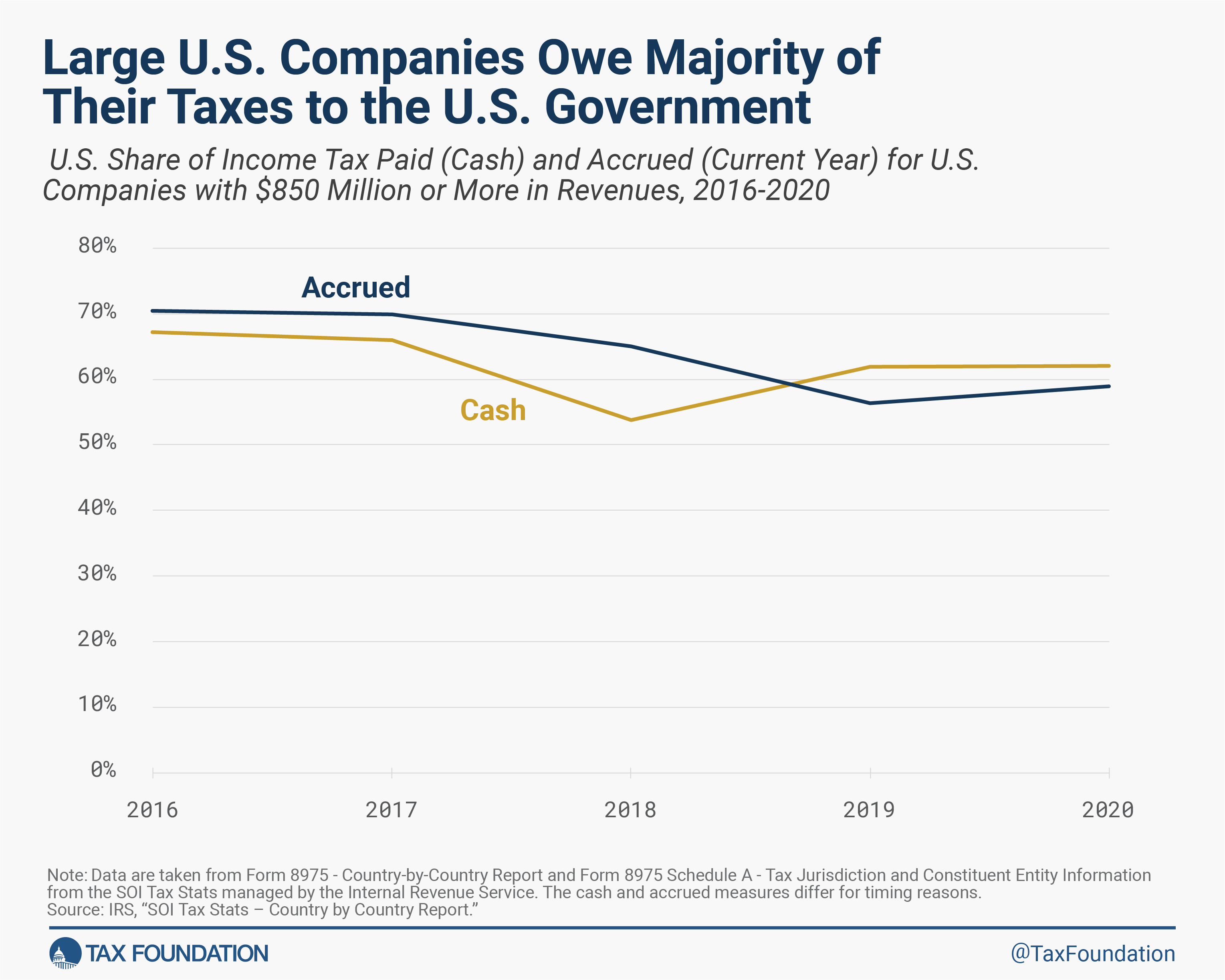

The Inside Income Service collects information every year on the place U.S. corporations with greater than $850 million in income pay taxes. These country-by-country experiences present that on each a money and accrual foundation, the U.S. share of taxes owed by these corporations was north of fifty p.c every year from 2016 to 2020. In 2020, U.S. corporations reported revenue tax paid on a money foundation of $311 billion in complete, with $193 billion—or 62 p.c—going to the U.S. The second-largest jurisdiction receiving U.S. corporations’ tax {dollars} was the UK, which took in $13 billion—or 4 p.c.

This pattern holds even for digital corporations, which Ambassador Tai talked about particularly. Digitalized enterprise fashions will be present in nearly any trade as of late, however info and companies are two key areas the place they’ve grow to be notably dominant.

Data corporations paid or owed about 71 p.c of their taxes to the U.S. authorities on common between 2019 and 2020. In 2020, info corporations paid $44 billion in taxes (money foundation), of which $30 billion (68 p.c) was paid to the U.S. Eire got here in second with U.S. info corporations paying $5 billion (11 p.c) in taxes there.

On common between 2019 and 2020, skilled companies owed about half of their taxes to the U.S. In 2020, the U.S. was the highest jurisdiction for money tax funds, making up $4 billion out of $8 billion in complete (50 p.c), and the UK got here in second with $500 million (6 p.c) in money tax funds.

Subsequent, underneath President Biden, the U.S. has taken steps to have our multinationals pay fewer taxes within the U.S. and extra taxes overseas. This yr marks the start of a brand new world minimal tax, spearheaded by the OECD with help from the U.S. Treasury, to make sure multinational corporations “pay their fair proportion.” Of its many options, the worldwide minimal tax essentially will increase the overseas tax burden of U.S.-based corporations whereas reducing the quantity of home tax owned. But when “taxes paid at dwelling versus overseas” is the metric the Biden administration desires to make use of to find out an organization’s Americanness, then many corporations that do enterprise throughout borders may quickly stop to be thought of American underneath the brand new minimal tax.

Furthermore, Ambassador Tai’s feedback neglect to acknowledge the menace U.S. companies face from different jurisdictions all over the world, together with digital companies taxes (mostly present in Europe), equalization levies, and different insurance policies primarily focused at U.S. corporations. By design, these taxes discriminate towards massive U.S. digital corporations and enhance the quantity of taxes U.S. corporations pay to different jurisdictions.

Ambassador Tai is correct to surprise what defines an American firm from a tax perspective. Till the 2017 tax reforms, U.S. insurance policies virtually inspired corporations to keep away from being headquartered within the U.S. However the premise of her query is defective; U.S. multinational corporations pay a major share of their taxes to the U.S. authorities. And if taxes paid to the US is the ambassador’s chosen metric, then insurance policies like the worldwide minimal tax and digital companies taxes run opposite to that.

A wiser strategy is to proceed constructing on the 2017 tax reforms—which considerably diminished incentives for inversions. By making a few of its short-term options—like full expensingFull expensing permits companies to right away deduct the complete value of sure investments in new or improved know-how, tools, or buildings. It alleviates a bias within the tax code and incentivizes corporations to speculate extra, which, in the long term, raises employee productiveness, boosts wages, and creates extra jobs.

—everlasting, whereas additionally working to roll again the tariffs put in place underneath the earlier administration, U.S. policymakers may assist corporations that began, grew, and have succeeded in America proceed to take action right here.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Subscribe

Share