Be aware: The next is the written testimony of Sean Bray, Director of European Coverage on the TaxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

Basis, ready for a hearing earlier than the European Parliament Subcommittee on Tax Issues (FISC) on January 23, 2024, titled, “Capital Beneficial properties Taxation within the EU.”

Expensive Chair Tang and Distinguished Members of the FISC Committee,

Thanks for the chance to offer testimony on capital positive aspects taxation within the EU.

Throughout EU Member States, tax charges on capital positive aspects common 18.6 p.c, although they differ extensively. Denmark fees the best high price of 42 p.c price. Finland and France cost 34 p.c, whereas Bulgaria and Romania cost 10 p.c. In the meantime, 5 Member States, together with Belgium, Czechia, Luxembourg, Slovakia, and Slovenia, have a zero p.c price beneath numerous circumstances.

The theme of this listening to is the hurt that non-harmonized capital positive aspects charges could cause within the EU. Presumably, some will argue that the hurt is coming from these 5 Member States with zero p.c charges. Others might also argue that it’s unfair to have decrease tax charges on capital positive aspects than on labor earnings and supply doubtful political motivations for why such variations exist within the first place. These arguments don’t inform the entire story.

Frankly, I agree that disparate capital positive aspects charges could cause hurt to the European economic system, and there’s a query of equity to debate. Nevertheless, it’s international locations with greater charges, not decrease charges, which might be inflicting probably the most hurt. Moreover, capital positive aspects must be thought-about alongside the company earnings taxA company earnings tax (CIT) is levied by federal and state governments on enterprise income. Many firms are usually not topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable beneath the person earnings tax.

. With out the broader image, it’s deceptive to focus solely on the capital positive aspects charges in these 5 Member States.

A Double Tax on Company Earnings

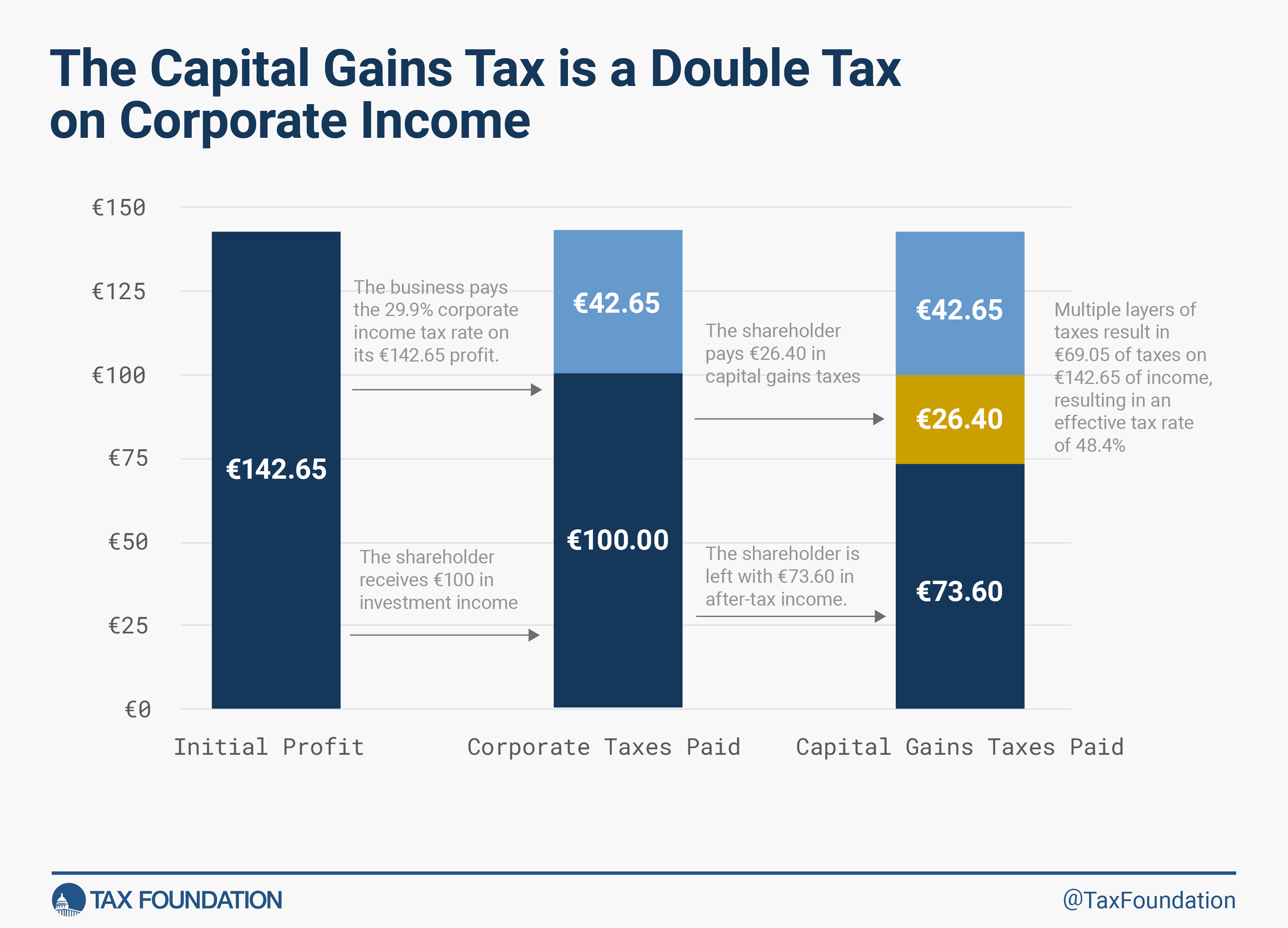

To start out, it’s important to grasp that the taxation of capital positive aspects locations a double tax on company earnings. Ideally, beneath a impartial tax system, every euro of earnings would solely be taxed as soon as. Nevertheless, this isn’t the case, as capital positive aspects face a number of layers of tax.

Earlier than shareholders pay taxes, the enterprise pays the company earnings tax on its income. Due to this fact, when the shareholder pays their layer of tax on the private stage, they’re doing so on capital positive aspects distributed from after-tax income.[1]

For instance, Determine 1 under exhibits the double tax burden on earnings in Germany, which faces a 29.9 p.c statutory company earnings tax price and a 26.4 p.c capital positive aspects price.

Which means, even in Member States with a zero p.c capital positive aspects price, this earnings remains to be being taxed by the company earnings tax. To compensate for this double layer of taxation, governments typically cost a decrease tax price on capital positive aspects than atypical earnings.

The tax price that includes the capital positive aspects price plus the company earnings price is named the built-in tax price on company earnings. This price is extra indicative of the real-world financial impression of capital positive aspects taxation than the easy capital positive aspects price.

Desk 1 exhibits that the common built-in tax price is far greater than the common capital positive aspects price. Mockingly, it additionally exhibits that company earnings in Belgium (a rustic with a zero p.c capital positive aspects price), faces the next built-in price than a number of Member States with non-zero capital positive aspects charges.

One other financial rationale for charging a decrease price is that almost all Member States don’t modify positive aspects for inflationInflation is when the final value of products and companies will increase throughout the economic system, decreasing the buying energy of a foreign money and the worth of sure belongings. The identical paycheck covers much less items, companies, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off because of greater prices and “bracket creep,” whereas growing the federal government’s spending energy.

. Which means buyers may be taxed on capital positive aspects that accrue because of price-level will increase somewhat than actual positive aspects.[2]

Significance of Saving and EU Capital Markets Union

Typically, greater capital positive aspects taxes create a bias in opposition to saving and funding, scale back capital formation, and sluggish financial progress.[3] Capital positive aspects taxes distort the choice to right away eat or save over time as a result of there’s an extra tax burden on saving.

These taxes may be particularly dangerous to entrepreneurship and small companies that require capital. The EU can not afford this given its growing old demographic and declining long-term progress tasks.

Moreover, if the built-in price on company earnings is excessive and curiosity is deductible, then the steadiness towards debt financing will likely be comparatively sturdy.[4] Companies will likely be extra more likely to finance their investments via debt somewhat than fairness, with fewer IPOs and personal choices.[5] This may be one more hindrance to attaining a vibrant EU Capital Markets Union.

Conclusion

Some could argue that capital positive aspects charges within the EU must be harmonized to a price as much as 40 p.c greater than the established order. This may hurt the European economic system.

As a substitute, policymakers ought to search for principled methods to extend saving, funding, and financial progress. If a harmonized EU capital positive aspects price of zero p.c makes politicians uncomfortable, then the second-best coverage possibility can be to a minimum of encourage long-term funding and saving with a zero p.c long-term capital positive aspects price.

Thanks once more for the chance to testify right here at the moment, and I sit up for your questions.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Subscribe

[1] Erica York, “An Overview of Capital Beneficial properties Taxes,” Tax Basis, Apr. 16, 2019, https://taxfoundation.org/analysis/all/federal/capital-gains-taxes/.

[2] Kyle Pomerleau, “How One Can Face an Infinite Efficient Tax Fee on Capital Beneficial properties,” Tax Basis, Jan. 7, 2015, https://taxfoundation.org/weblog/how-one-can-face-infinite-effective-tax-rate-capital-gains/.

[3] Daniel Bunn and Elke Asen, “Financial savings and Funding: The Tax Therapy of Inventory and Retirement Accounts within the OECD,” Tax Basis, Could 26, 2021, https://taxfoundation.org/savings-and-investment-oecd/.

[4] Elke Asen, “Double TaxationDouble taxation is when taxes are paid twice on the identical greenback of earnings, no matter whether or not that’s company or particular person earnings.

of Company Earnings in the US and the OECD,” Tax Basis, Jan. 13, 2021, https://taxfoundation.org/information/all/federal/double-taxation-of-corporate-income/#Distortions.

[5] Rudd A. de Mooij, “Tax Biases to Debt Finance: Assessing the Downside, Discovering Options,” IMF, Could 3, 2011, https://www.imf.org/exterior/pubs/ft/sdn/2011/sdn1111.pdf.

Share